Earning profits/incomes is the core objective of any business enterprise. In order to earn profits, businesses generate revenues as well as incur expenses. The difference between revenues earned and expenses incurred is the net income earned by the business. Correct ascertainment of income is essential for two main reasons – to gauge profitability as well as to compute tax liability. The calculation of income for both these purposes however varies as they are guided by different laws.

This article looks at meaning of and differences between these two types of income calculations – accounting income and taxable income.

Definitions and meanings

Accounting income:

Accounting income is the profit or loss earned by a business, that is calculated on the basis of its books of accounts prepared in accordance with jurisdictional accounting standards.

In order to calculate accounting income, all revenues for the period are recognized on the credit side of the profit and loss account and all expenses are recorded on the debit side. The difference between the recorded revenues and expenses is the accounting income. It is thus reported in the profit and loss account that forms part of the financial statements.

Accounting income is what stakeholders such as investors, creditors, bankers etc. rely on while assessing the performance of an entity.

The basis of computation of accounting income is the accounting standards, principles and rules laid down by the specific jurisdictional law. For example, the calculation of accounting income should comply with US GAAP in USA; and in many other countries, International Financial Reporting Standards (IFRS).

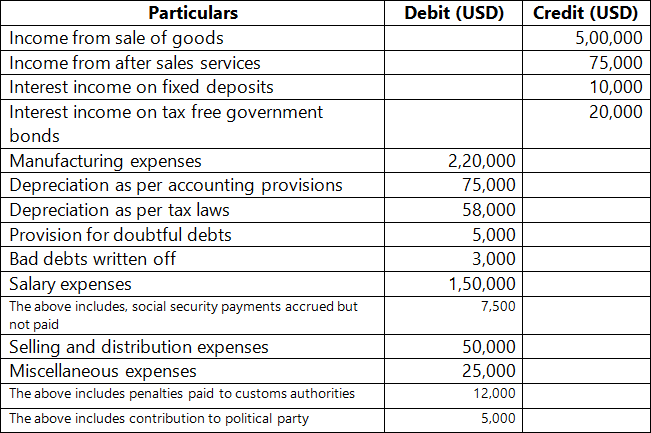

Numerical example – ABC Inc. has the following revenues and expenses for the fiscal year 2020:

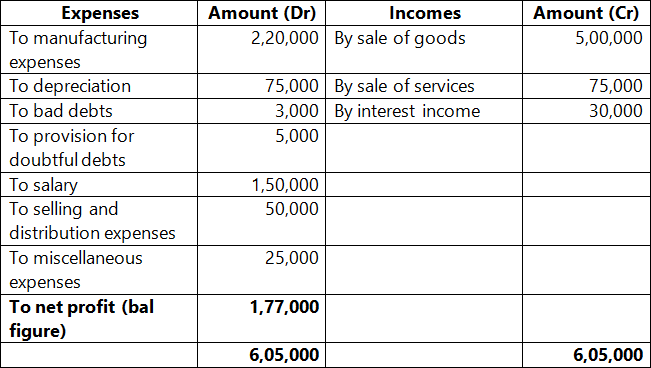

The calculation of accounting income is as follows:

Taxable income:

Taxable income is the profit or loss that is calculated after giving effect to allowances and disallowances as per jurisdictional tax laws.

Once an entity has computed its accounting income, it proceeds to make adjustments to this income to compute taxable income. These adjustments are those allowances and disallowances that are mandated by the tax laws of the country. In the USA, for example, tax laws are formulated by the Internal Revenue Service (IRS) and are termed as Internal Revenue Code (IRC).

For example, accounting income is computed after considering the effect of certain provisions such as provisions for bad and doubtful debts. Tax laws however disallow such provisions and allow the same only on actual write off of bad debts. This provision will thus be added back to the accounting income to arrive at the taxable income.

The computed tax liability is reported in the tax returns of the entity. It forms the basis for the calculation of its tax liability.

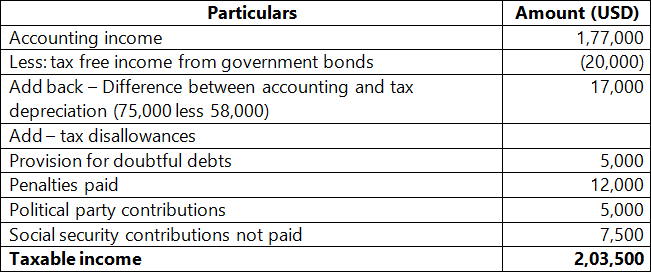

Continuing the same example as above, the calculation of taxable income of ABC Inc is as follows:

As can be seen there is considerable difference between accounting income of $1,77,000 and taxable income of $2,03,500, on account of various tax allowances and disallowances.

Difference between accounting income and taxable income

The nine key points of difference between accounting income and taxable income are detailed below:

1. Meaning

- Accounting income is the difference between the revenue earned and expenses incurred by an entity, as computed from its books of accounts.

- Taxable income is the resultant income computed after making allowances and disallowances to accounting income in line with tax laws.

2. Basis of calculation

- The basis of calculation of accounting income is the books of accounts prepared by the entity.

- The basis of calculation of taxable income is the accounting income and the provisions contained in the tax laws.

3. Hierarchy

- Accounting income is calculated first.

- Taxable income is calculated subsequently after adjusting the accounting income for tax allowances and disallowances.

4. Statutory compliance

- Accounting income must comply with the jurisdictional accounting standards and rules. For example, US GAAP in the USA, Ind-AS in India etc.

- Taxable income must comply with jurisdictional tax laws. For example, IRC in the USA, Income-tax Act in India etc.

5. Accrual or cash basis

- Accounting income is generally prepared on mercantile or accrual basis.

- Tax laws however generally result in a combination of accrual and cash basis being followed.

6. Subject to audit

- Calculation of accounting income is subject to statutory audit.

- The calculation of taxable income is subject to tax audit.

7. Reporting

- Accounting income is reported in the financial statements of the entity. It is reported in the profit and loss account or income statement.

- Taxable income is reported in the tax return of the entity.

8. Assessment

- Calculation of accounting income is not subject to any external assessment.

- Taxable income is assessed by tax authorities of the IRS. They may make adjustments to the taxable income if they find any non-compliance with tax laws.

9. Purpose of calculation

- Accounting income is calculated primarily for reporting to various stakeholders. It forms the basis of evaluation of the entity’s performance on the basis of which stakeholders take various decisions.

- The purpose of computing taxable income is preparation of the tax return and determination of tax liability.

Conclusion – accounting income vs taxable income

Essentially the difference between accounting and taxable income arises due to the difference in treatment of certain incomes and expenses under accounting law and under tax laws. The exercise of computing accounting income is an ongoing process as financial transactions are recorded daily in books of accounts. Taxable income, on the other hand, is computed as when the need to compute and pay taxes arises which may be quarterly or annually. Computation of both these incomes is however important and must be done with equal accuracy by entities. This is also essential as entities typically recognize deferred tax or liability in its books to account for timing differences between accounting and taxable income.