A company’s capital, which represents its ownership structure, is divided into shares. Determining and analyzing valuation of the shares of a company is important for several stakeholders. For investors – to know the worth of their investments, potential investors to gauge potential of the shares, for banks to gauge credibility for extending lending facilities, insurance companies to determine insurance coverage etc. There are primarily two types of share valuation figures that stakeholders look for.

This article looks at meaning of and differences between these two types of share valuations– book value per share and market value per share.

Definitions and explanations

Book value per share

Book value per share is the per share value of the equity of a company based on its financial statements. It is essentially the book net worth of the company per equity share.

It can be calculated based on the following formulas:

Book value per share = (Total shareholder’s equity – value of preference shares*)/No. of equity shares outstanding

where,

value of total shareholders’ equity = Total assets minus total liabilities

*preference shares value is excluded in calculating book value per share as dues of preference shareholders are settled before equity shareholders

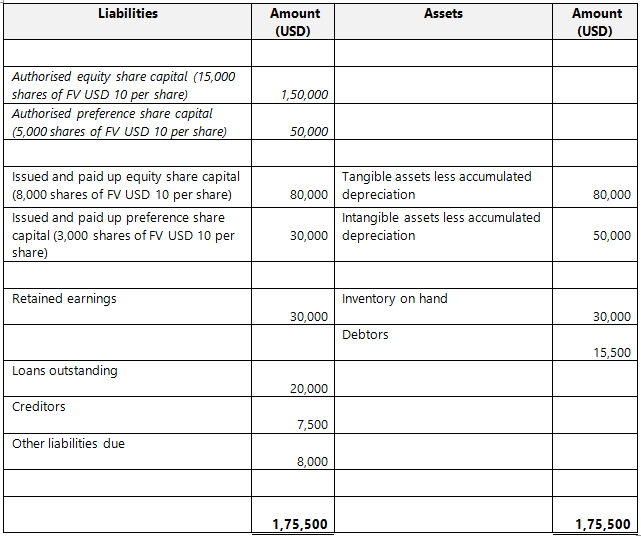

Let us consider an example of a financial statement to calculate the book value per share:

Book value per share = (Value of shareholder’s equity – value of preference shares)/No. of equity shares outstanding

= (140,000* – 30,000)/8,000

Book value per share = $13.75 per share

*Value of shareholders’ equity = Total assets – Total liabilities

= 175,500 – (20,000+7,500+8,000)

= 175,500 – 35,500

= 140,000

As can be seen above, the value of shareholder’s equity for calculating book value per share is essentially face value of paid up equity share capital plus total of all retained earnings.

As book value is derived from balance sheet it is based on historical costs and thus does not necessarily represent the actual market worth of the share.

Stakeholders can compare the book value per share of the company with the market value per share to determine if the company is undervalued or overvalued. This has been elaborated on in the subsequent paragraph in the discussion on market value per share.

Market value per share:

The market value per share is the price at which the share is currently traded i.e., the price at which it can be purchased and sold in an arm’s length transaction.

In the case of a company listed on any stock exchange, its market value per share would be the price at which it is being traded on such stock exchange. This market value per share can change frequently, in fact several times during a trading day.

In case of a non-listed company, market value per share is tougher to determine as the shares are not freely traded. Several other methods can be used to calculate this value such as discounted cash flow method, net asset value method, net internal rate of return method etc.

Market value per share can be affected by several factors such as financial performance of the company, outlook of the industry or sector to which the company belongs, demand and supply conditions in the market, investor sentiment and several other macro-economic conditions.

By comparing market value per share to book value per share, investors can gauge price potential of the share. If the market value is less than the book value per share, it can be said to be undervalued and thus the share investment may have scope for price increase.

Investors also rely on market value per share to calculate several important ratios which also help in investment decision making such as P/E ratio, market to book ratio, dividend yield etc.

Difference between book value per share and market value per share:

The key points of difference between book value per share and market value per share have been detailed below:

1. Meaning

- Book value per share is the price per equity share as per historic values reported in the financial statements of the company.

- Market value per share is the price of the equity share at which it can be freely traded amongst unrelated parties.

2. Basis of determination

- Book value per share is calculated on the basis of values recorded in the financial statements, specifically the balance sheet of the company.

- Market value per share, in case of listed companies is determined from the values reflected in active stock exchanges.

3. Formulas

- Book value per share is derived by applying a formula:

(Total shareholder’s equity – value of preference shares)/No. of equity shares outstanding - Market value per share, on the other hand, is not calculated by any fixed formula but is in fact derived from stock market data.

4. Factors affecting the value

- Book value per share is impacted by specific tangible factors – historical costs and book profitability of the company.

- Market value per share is additionally affected by several intangible factors such as – market and investor sentiment, industry outlook, government regulations etc.

5. Time factor

- Book value per share considers past data as it considers historical values reported in financial statements.

- Market value per share is more forward looking as it considers outlook on industry and sector performance.

6. Frequency of updating of values

- Since financial statements are not drawn up on a daily basis but at certain intervals maybe quarterly half yearly or annual, book value per share can be accurately measured generally only at these intervals.

- Market value can generally be assessed on a much more frequent almost daily basis. Especially in the case of listed companies whose shares are traded on stock exchanges daily.

7. Represents

- Book value per share essentially represents the financial strength of the company in terms of the value of its assets.

- Market value per share represents the marketability of shares of a company.

Conclusion – book value per share vs market value per share:

Both book value per share and market value per share can indicate the financial strength of a company. Understanding both these values are relevant to stakeholders especially to investors as the valuation of the company can be best gauged by comparing both these values and calculating several financial ratios which are key to investment decision making.