Various types of books of accounts are prepared to record financial transactions of an enterprise. These books begin with the journal where entries are recorded and generally culminate with preparation of trial balance from where financial statements are prepared. Transactions can be broadly categorized into cash based transactions which involve an immediate inflow or outflow of cash and non-cash based or credit transactions which do not immediately impact entity’s cash position. There are specific books of accounts that are prepared to record cash based transactions.

This article looks at meaning of and differences between two types of books of account that are used to record cash based transactions – cash account and cash book.

Definitions and meanings

Cash account:

A cash account is a ledger account to which previously journalized cash related accounting entries are posted. These postings are typically done at the close of the accounting period. The following type of accounting entries find their way to the cash account:

- Payment of physical cash

- Receipt of physical cash

- Deposit of physical cash in a bank account

- Withdrawal of physical cash from a bank account

Thus, only transactions that involve inflow or outflow of physical cash are posted here. Pure bank transactions are not posted to the cash account.

A cash account is prepared as a ledger account in the T format. It is closed at the end of the accounting period and it’s closing balance is transferred to the trial balance from where it reflects in the current assets of the balance sheet.

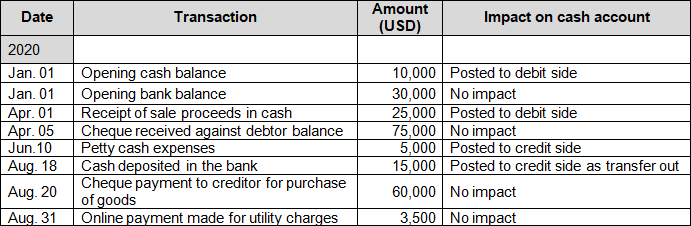

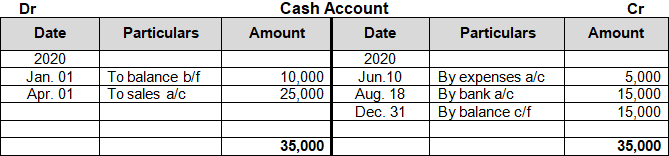

Example of cash account

The following transactions have been recorded in the journal of ABC Inc:

The cash ledger account in T format has been prepared below:

Cash book:

A cash book is a subsidiary book in which all cash based accounting transactions are recorded. A cash book records all receipts and payments along with detailed narrations which explains their nature. Cash receipts are recorded on the left side and cash payments on the right side.

There are 3 types of cash books:

- Single column- records only pure cash transactions and is very close to a simple cash account described above.

- Double column – records both cash and bank transactions.

- Triple column – records the above plus information of discounts allowed and received received.

The selection from the above three types of cash book to be used depends on the entity’s requirement.

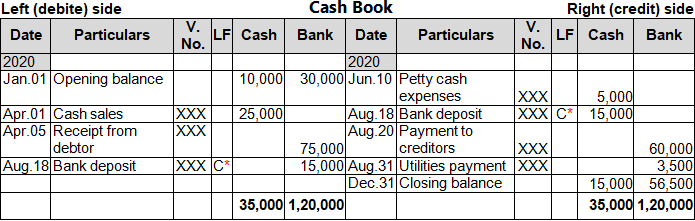

Continuing the same example as above, the double column cash book will be prepared as follows:

*Denotes a contra entry i.e., an entry that is passed on both sides of cash book. Deposits and withdrawals of cash are typical circumstances in which a contra entry is needed. Additionally, a contra entry is also passed when a previously received check from a debtor is deposited into the bank account of the business.

Maintaining a cash book is important as it provides an instant account of cash and bank balances. It thus helps the management to have a check on its liquidity, so that they can manage the cash and bank transactions more efficiently.

Difference between cash account and cash book

The seven key points of difference between cash account and cash book are as follows:

1. Meaning

- A cash account is a ledger account to which all transactions that involve an exchange of physical cash are posted.

- A cash book is a subsidiary book of account which records in detail the cash based transactions on an ongoing basis.

2. Type of transactions recorded

- A cash account records only pure cash transactions.

- The type of transactions recorded by a cash book depends on the type of cash book prepared. Single column records only cash transactions whereas double and triple column record both cash and bank transactions.

3. Nature

- A cash account is a ledger account.

- A cash book functions as both a journal as well as a ledger. This is because it serves as a book of original entry for all cash-based transactions as well as it reflects the cash and bank balances instantly.

4. Source of preparation

- The cash account is dependent on and prepared on the basis of entries in the journal.

- The cash book is an original book of entry i.e., Cash and bank transactions are recorded here first.

5. Folio

- The cash account records journal folio to indicate the journal reference from where the entries are posted.

- The cash book records ledger folio to indicate the ledger account to which the entries are subsequently posted.

6. Frequency of preparation

- Cash account is generally prepared after recording of all accounting entries, at end of the accounting period or periodically within the accounting period.

- Cash book on the other hand is prepared on an ongoing basis, as and when transactions take place.

7. Purpose

- The main purpose of preparing the cash account is to ascertain the year end balance of the cash to be ultimately transferred to the trial balance.

- Recording cash based transactions and ascertaining cash balance is the primary purpose of preparing a cash book. Additionally, it also assists in effective cash control and management as it is compiled on a real time basis.

Conclusion – cash account vs cash book

Cash and bank balances are very important for any business. They are, in fact, the main motive for businesses to operate. Thus, management has to pay special attention to the timely and accurate recording of cash and bank transactions. To ascertain accuracy, both the cash account and cash book are periodically reconciled. Cash account and cash column balance of cash book is reconciled with the actual cash in hand whereas bank column balance of cash book is reconciled with the bank statement or the balance at bank account.