Preparation of books of accounts is the first step towards financial reporting and analysis. Thereafter, reviewing and analyzing financial data is the next important step that enables management and other stakeholders to take informed decisions. Various analysis tools are employed for this purpose and one key tool is the calculation and analysis of financial ratios. A financial ratio is a relative measure of two or more different financial values that is intended to reflect on various aspects of an entity’s financial health. Financial ratios, for example, can uncover many facets of an undertaking like profitability position, liquidity position, operational efficiency and the level of risk present for investors etc.

This article looks at meaning of and differences between two types of liquidity ratios – current ratio and quick ratio.

Definitions and meanings

Current ratio

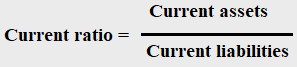

Current ratio is a liquidity ratio that exhibits an entity’s ability to service its short-term liabilities through the use of its available current assets. The formula to calculate current ratio is:

Current assets comprise of an entity’s cash in hand and bank balances plus any assets that are expected to be monetized or consumed within a short term (i.e., less than one year) period. These assets typically include accounts receivable, short term deposits, advance payments and inventories etc.

Current liabilities are the debts and payables of an entity that are required to be paid off within a short-term (i.e., less than one year) period. These include creditors arising due to purchase of goods and services, accrued expenses and short term borrowings etc.

Commercial entities take on several liabilities during the course of their normal day-to-day operations. These may include creditors for various routine business expenses or even short-term debt to tide over short-term liquidity crunch. At the same time, entities also accumulate several receivables, primarily originating from their sales transactions. The current ratio thus indicates whether the day-to-day revenue generation of an entity is sufficient to meet its day-to-day obligations. Due to this, the current ratio is also commonly referred to as working capital ratio.

Example:

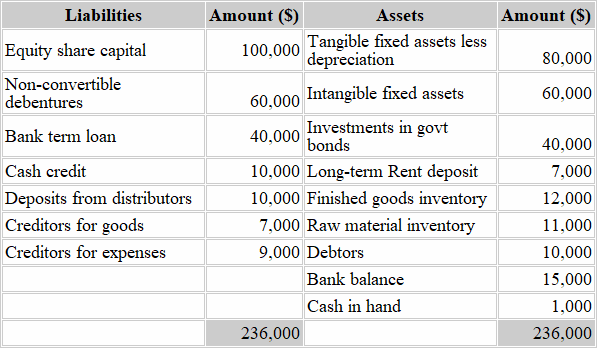

Calculate current ratio from the balance sheet of David Inc. as on 31st December 2021

Current ratio = (Inventory+Debtors+Bank and cash balance)/(Cash credit+short term deposits+creditors)

= (12,000+11,000+10,000+15,000+1,000)/(10,000+10,000+7,000+9,000)

= 49,000/36,000

= 1.36

David Inc’s current ratio is 1.36 which tells us that its current assets are 1.36 times more than its current obligations. Alternatively, the ratio may also be expressed as 1.36:1, where the number “1.36” represents current assets and the number “1” represents current obligations. This expression reveals that for each one dollar of current liabilities, David Inc. owns current assets of the value of 1.36 dollars.

In many undertakings, a current ratio of 2:1 is considered ideal, which means an entity has a sound liquidity position when its short-term assets are twice as many as its short-term liabilities. Anything less than 1 may indicate inadequate working capital and a liquidity risk to all concerned parties, especially to creditors of the entity.

Quick ratio

Quick ratio is a more conservative and modified liquidity ratio that indicates the entity’s ability to services its short-term obligations through its more liquid or near-term assets. Quick ratio is considered a more rigorous solvency test than the current ratio because it indicates the entity’s capacity to clear its current dues in a relatively shorter period.

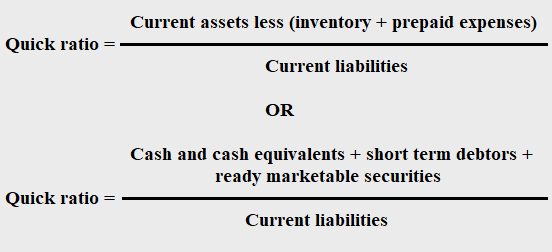

Quick ratio can be calculated using any of the following two formulas:

Essentially, quick ratio considers only the entity’s most liquid assets – typically those ones that can be converted into cash in 90 days or less without adversely affecting the price that they will fetch. Thus, current assets such as inventory and long-term debtors with greater than 90 days credit period are excluded as they are not likely to be monetized within the near term, without sacrificing on their value through discounts etc. Other common names of quick ratio are acid test ratio and liquid ratio.

Continuing the above example, David Inc’s quick ratio can be calculated as follows:

Quick ratio = (10,000+15,000+1,000)/(36,000)

= 0.72

An ideal quick ratio is considered to be 1:1, meaning the entity can easily liquidate its short-term assets to pay off its short-term obligations. A ratio greater than one indicates a higher liquidity position whereas a ratio lesser than one indicates an inability on the part of the entity to be able to clear its outstanding immediately.

Difference between current ratio and quick ratio

The five key points of difference between current ratio and quick ratio have been listed below:

1. Meaning

- Current ratio is a financial or accounting ratio that quantitatively measures the short-term liquidity position of an entity i.e., the ability of an entity to use its short term assets to clear all of its short-term liabilities.

- Quick ratio is a modified liquidity ratio that indicates the ability of an entity to clear its current liabilities immediately, by monetizing its near-term more liquid assets.

2. Formula

- As presented above, the current ratio is derived by dividing an entity’s total current assets by its total current obligations.

- As presented above, quick ratio is arrived at by dividing near term liquid assets by total current liabilities i.e., the current assets number in numerator is reduced by the value of all types of inventories and prepaid expenses, if any.

3. Assets considered in formula

- In the calculation of current ratio, all current assets which can be liquidated to cash within a short term period (maximum one year) are considered.

- In the calculation of quick ratio, all liquid assets which can be monetized, without a compromise in their value, within a very short period (mostly 90 days) are considered. Thus, assets which take longer to liquidate or which can be liquidated faster but at a discounted cost such as inventory and longer period debtors etc. are excluded from the calculation.

4. What the ratio indicates

- Current ratio reflects the short-term liquidity position of the entity i.e., it indicates whether the short-term or current assets owned by an entity are sufficient to meet its short-term obligations.

- Quick ratio indicates the immediate debt-clearing ability of the entity i.e., it indicates whether the highly liquid or near-term assets of an entity are sufficient to meet its short-term obligations.

5. Ideal value

- The ideal current ratio is considered to be 2:1; i.e., when the current assets of a business are valued at two times of its current liabilities.

- The ideal quick ratio is considered to be 1:1 i.e., when the value of near-term assets of a business are practically equal to its current liabilities.

Conclusion:

In terms of calculation, the main difference between current ratio and quick ratio is that the former is arrived at by taking into account all the current assets while the latter is calculated by considering only the liquid assets (i.e., current assets less inventories and prepaid expenses). Both the ratios help measure entities’ liquidity position and analysts often use them in conjunction with each other.

Current and quick ratios are important to many stakeholders; for example, they assist managers while they assess the adequacy and health of working capital to take appropriate decisions for better economic performance of their entity. Suppliers and creditors use them as indicators for determining whether the entity has sufficient ability to clear its current dues and whether it is worthy to extend credit. For potential investors, these ratios are indicators of liquidity risk the entity may be susceptible to.

An inadequate liquidity ratio can be a red flag for several stakeholders and it may warrant a more deeper assessment of financial position of the entity in question. Liquidity ratios, however, can only reflect upon a part of financial position. In order to gauge the full extent of financial health, analysts need to apply them in conjunction with several other ratios. Additionally, they must not only rely upon the ratio numbers but also take a hard subjective look on the nature and quality of each individual asset that forms part of the total current assets.