Funding is a core need of most businesses. It can primarily take two forms – equity or debt. Equity involves transferring part ownership of the company to the funder in exchange for funds. Debt involves taking of loans or accepting of deposits, without partying with any part of ownership of the entity. In either case, the funder has to be compensated in some form for the funds that he has provided.

This article looks at meaning of and differences between two different types of compensation received by funders – dividend and interest.

Definitions and explanations

Dividend:

Dividend is a share of profit received by shareholders of a company. When a company makes a profit it may allocate a part of this profit amongst its shareholders in the form of dividend. Each shareholder receives dividend in proportion to the number of shares he or she holds.

For example, XYZ Co. Ltd makes a profit of $1,00,000 in the year. It decides to distribute 50% of this profit to its shareholders, who are 10,000 in number. This means that the declared dividend would be $5 per share (50,000/10,000). If an investor holds say 20 shares, then he will receive $100 (= $5 × 20 shares) as dividend.

It is not necessary that a company will distribute dividend each year. If it makes a loss or decides to retain its profits within the business then it may not declare any dividend in the year.

Dividend that is recommended by board of directors and approved by the shareholders at their annual general meeting is termed as ‘final dividend’. Dividend that is declared by board of directors at any time between 2 consecutive general meetings when the company is expected to earn profit is termed as ‘interim dividend’.

Interest:

Interest is the compensation paid to lenders for the amounts loaned by them. Interest is paid over and above the payment of the principal amount of the loan.

An entity that requires funding for its business operations may choose to borrow these funds from banks or financial institutions. They may also borrow money in form of public deposits or debentures. Interest is the amount to be paid by the entity to these lenders as a price for allowing the use of borrowed money.

Every loan installment that is repaid by a borrower has a component of both principal sum as well as interest amount.

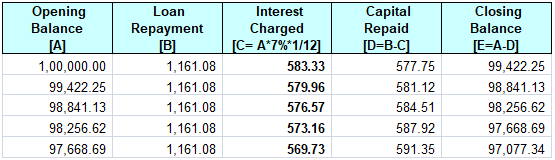

Interest is generally expressed as percentage which is charged per month or per annum. An extract of an interest schedule of a loan is as follows:

- Loan amount: $1,00,000

- Interest rate: 7% per annum.

- Loan tenure: 10 years

- Equated monthly installment (EMI): $1,161 per month

As can be seen above, the proportion of interest in each loan installment reduces as the amount of principal outstanding reduces.

Difference between dividend and interest:

The difference between dividend and interest has been detailed below:

1. Meaning

- Dividend is a share of profit distributed to shareholders of a company.

- Interest is the amount paid to lenders on loan amounts which is paid over and above the principal amount of loan.

2. Related to

- Dividend is related to the equity i.e., capital contribution of a company.

- Interest is related to loan funds of a company.

3. Recipient

- Dividend is received by shareholders – both preference and equity shareholders.

- Interest is received by lenders such as banks, financial institutions, and debenture holders.

4. Mandatory nature

- Dividend is not a mandatory payment – it may be declared if profits are earned or it may not be declared and profits may be retained in the business.

- Interest payment is mandatory and has to be paid as per the terms of the loan.

5. Payment if profit is nil

- Dividend is not declared and distributed if profits or retained earnings are insufficient or nil.

- Interest has to be paid even if the company makes no profits and is in losses.

6. Expressed as

- Dividend is generally expressed as an amount per share held.

- Interest is generally expressed in the form of annual percentage.

7. Frequency of payment

- Dividend is generally paid annually as final dividend or in between financial periods as interim dividend.

- Interest is generally paid in each loan installment, which may be monthly or at any other frequency as provided in the terms of the loan.

8. Approval

- Dividend payment is declared by the board of directors and requires approval of the shareholders in its general meeting.

- Interest payment does not require approval of shareholders.

9. Governed by

- Dividend declaration and payment is governed by dividend policy mentioned in the articles of association of a company.

- Interest payment is government by the terms of the loan agreement.

10. Impact on profit and loss account

- Dividend is allocated after finalization of profit of the company and is an appropriation of profit of the company.

- Interest is a charge of profit and reduced before determining the profit of an entity.

Dividend vs interest – tabular comparison

A tabular comparison of dividend and interest is given below:

|

||||

| Meaning | ||||

| Share of business profit appropriated towards shareholders of a company | Compensation paid to lenders on loan amounts | |||

| Related to | ||||

| Equity of the company | Debt of the entity | |||

| Recipient | ||||

| Shareholders | Lenders | |||

| Mandatory in nature | ||||

| Not mandatory | Mandatory | |||

| Payment if profit/retained earnings is nil | ||||

| No | Yes | |||

| Expressed as | ||||

| Amount per share held | Percentage per annum (or any other period as per loan terms) | |||

| Frequency of payment | ||||

| Generally annual, maybe mid-term in the case of interim dividend | Part of installment amount (frequency as per loan terms) | |||

| Approval | ||||

| Shareholder approval required for payment | Shareholder approval not required for payment | |||

| Governed by | ||||

| Dividend policy laid out in articles of association | Terms of the loan agreement | |||

| Impact on profit and loss account | ||||

| Appropriation of profit | Charge on profit | |||

Conclusion – dividend vs interest

Both interest and dividend are important aspects of funding operations of a company. While interest is a cost for the company as it is a charge on its profits and has to be mandatorily paid, dividend is a part of profits of the company is the allocable surplus that is given back to the shareholders as a compensation for their capital contribution. This impact of interest and dividend plays an important role in determining the type of funding a company may opt for – raising of capital or raising of debt.