All businesses require funds to run their business operations. These funds can be internally generated by the business. If however, the business is unable to generate sufficient funds internally it may rely on external funds. Loans are a type of external funds can be availed from banks and other financial institutions. Loans may also be availed by individuals to fund their personal needs such as purchase of car, house, funding of education etc. Loans almost always carry an interest obligation which is a compensation to be paid to the lender over and above the repayment of the principal sum. The rate at which interest is levied can vary basis the type of lender and the purpose for which the loan is availed.

This article looks at meaning of and differences between two different types of interest levies – fixed and floating rate of interest.

Definitions and meanings

Fixed rate of interest:

Fixed rate of interest implies that the rate of interest charged on the loan remains constant during the entire tenure of the loan. Fixed rate of interest does not vary irrespective of the changes that may take place in market rates of interest.

Example:

XYZ Co has availed a business loan of USD 1,00,000 from ABC Bank at a fixed interest rate of 18% p.a with tenure of 3 years. This will result in an EMI of USD 3,615 to be paid each month for the tenure of 3 years.

The EMI amount will remain constant throughout the tenure of the loan.

Fixed rates have lower risk involved for the borrower as they have certainty with regards to the instalment amounts that they will need to pay in the future throughout the term of the loan.

Floating rate of interest:

Floating rate of interest implies that the interest rate charged on the loan does not remain constant during the tenure of the loan and fluctuates in sync with the market rate.

Most loans with floating rate of interest will have a benchmark rate attached to it and specified in the loan terms. Any change in this benchmark rate will also change the rate of interest of the loan. The benchmark rate can include London Inter-bank Offered rate (LIBOR), Cost of Funds Index (COFI) etc.

Example:

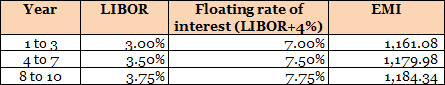

Mr. A has availed a mortgage from a bank for purchasing his house. The mortgage is of USD 1,00,000 with a floating rate of LIBOR+4% for tenure of 10 years. His loan repayment schedule may be as follows:

As can be seen above, the EMI amount will keep changing during the loan tenure if it has a floating rate of interest attached to it.

Floating rate of interest may initially be lower than fixed rate of interest on the same type of loan. In fact some banks and financial institutions offer a low introductory rate which may be stepped up with time and in response to changes in the benchmark market rate.

Differences between fixed rate and floating rate of interest:

Difference between fixed rate and floating rate of interest has been detailed below:

1. Meaning

- Fixed rate of interest is when the rate of interest applied on a loan remains unchanged during the loan term.

- Floating rate of interest is when the rate of interest charged on the loan is not constant and changes in response to changes in market rate during the loan term.

2. Response to change in market benchmark rates

- Fixed rate of interest does not get affected by movement in market rates or benchmark rates.

- Floating rates change in response to change in market rates. In fact floating rates are often attached to and dependent on certain benchmark rates.

3. Impact on loan repayments

- In fixed rate loans, monthly loan repayment amounts remain constant throughout the loan tenure.

- In floating rate loans, monthly loan repayment amounts may keep changing throughout the loan tenure.

4. Expressed as

- Fixed rate of interest is expressed as a flat rate without reference to any other rate.

- Floating rate of interest is generally expressed with reference to a benchmark rate. For example, floating rate can be ‘LIBOR+4%’

5. Certainty for borrower – risk involved

- Fixed rate loans have lower risk for the borrower as they have certainty on monthly payment obligations during the loan tenure.

- Floating rate loans have higher risk as the borrower does not have certainty regarding amount of monthly payment obligations.

6. Quantum

- Fixed rate of interest is generally higher than floating rate of interest as they do not incorporate any margin for increase in the rate at a later stage of the loan.

- Floating rate of interest loans may also be offered at significantly lower introductory rates at the beginning of the loan tenure. These may increase with passage of time and with changes in market rates.

7. Opted for by borrower

- Fixed rate of interest is generally opted for by borrowers when the prevailing rates are low to lock in this beneficial low rate.

- Floating rates may be opted for by borrowers when they find fixed rates being offered too high.

8. Offered by lender

- Fixed rates of interest are generally offered by lenders when the loan tenure is shorter generally on lower value loans of terms up to 5 years.

- Floating rates of interest are generally offered by lenders for higher value loans with longer tenure. This safeguards the interests of the lender also as it does not lock in an interest rate for an unreasonably long period of time.

Fixed rate vs floating rate of interest – tabular comparison

A tabular comparison of fixed rate and floating rate of interest is given below:

|

||||

| Meaning | ||||

| Rate of interest remains the same during the entire term of the loan | Rate of interest that changes with changes in benchmark rates | |||

| Response to change in market benchmark rates | ||||

| No impact | Changes when benchmark market rates change | |||

| Impact on loan payments | ||||

| Amount of Loan payments remain constant during the loan tenure | Amount of loan payments fluctuate with change in interest rate | |||

| Expressed as | ||||

| Flat rate | With reference to benchmark market rate | |||

| Certainty for borrower – risk involved | ||||

| Lower risk as there is certainty for borrower | Higher risk as there is no certainty for borrower | |||

| Quantum | ||||

| Higher | Generally lower to begin with | |||

| Opted for by borrower | ||||

| When applicable rates are low so as to lock in low rates | When fixed rate available is too high | |||

| Offered by lender | ||||

| On lower value loans with short tenure (generally up to 5 years) | On high value loans of long tenure | |||

Conclusion – fixed rate vs floating rate:

A borrower can choose to opt for fixed rate or floating rate interest based on whether certainty of loan payment is important or whether he can risk a floating rate with the hope of ultimately being subject to a lower interest rate. In reality, however most tenures of longer term can be offered in a combination of these two rates, with rate being fixed for the first few years and it converting into a floating rate for the balance years of the loan tenure.