The financial condition of any business is reflected in its financial statements – its profit and loss account (or income statement) and balance sheet. In order that the financial statements reflect the true and fair view of the financial position, it is imperative that the transactions are appropriately recorded in the books of accounts. The accounting cycle from where transactions flow to the financial statements begin with accounting in the journal, to posting to ledger accounts and compiling of trial balance.

This article looks at meaning of and differences between two important steps of the accounting cycle –ledger and trial balance.

Definitions and meanings

Ledger:

The ledger is the principal account book which is a comprehensive set of all accounts impacted by the business transactions. All transactions accounted for in the journal are transferred to i.e.: posted to each respective ledger account. Thus the ledger is a comprehensive record of all business transactions recorded account wise.

The ledger contains all real, personal and nominal accounts.

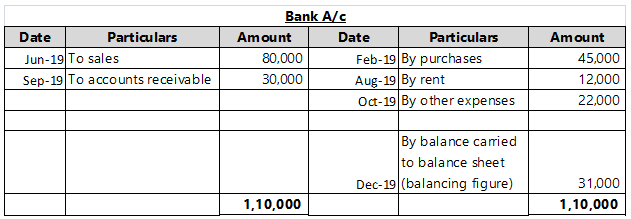

An example of a ledger of bank account is as follows:

The ledger is prepared in ‘T’ format. All debits to the account are posted on the left with the prefix – ‘To’ and all credits to the account are posted on the right with the prefix – ‘By’. At the end of the accounting period, each ledger account is totaled and the balancing figure is carried forward to the profit and loss account or balance sheet as applicable.

These ledger account balances are also used to compile the trial balance.

Trial balance:

Trial balance is a list of all real, personal and nominal account balances compiled from the individual ledger accounts.

Trial balance is compiled in columnar format, with columns on the left reflecting accounts with debit balances and columns on the right reflecting accounts with credit balance.

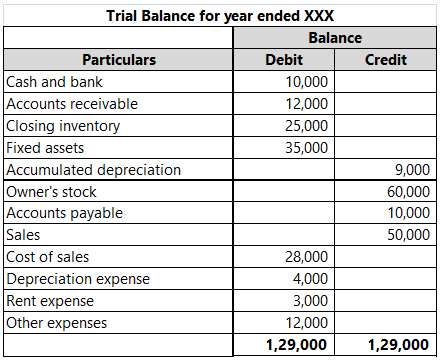

An example of a trial balance is as follows:

If transactions are appropriately recorded as per double entry accounting system, the trial balance will tally i.e.: the total of debit balances will match with the total of credit balances.

The trial balance is an overview of all account balances after recording all business transactions of a particular accounting period. The trial balance serves as a check that the accounts are in balance.

Differences between ledger and trial balance

The difference between ledger and trial balance have been detailed below:

Meaning

- The ledger is a principal book of account – in which all business transactions are classified and posted account wise.

- Trial balance is a summary list of all real, personal and nominal account balances prepared from the respective ledger accounts.

Hierarchy in accounting cycle

- Ledger is the book of second entry and is prepared by posting entries recorded in the journal.

- Trial balance is compiled subsequent to posting to all ledger accounts

Quantum of information

- Ledger has comprehensive information on all business transactions as each accounting entry is posted entry wise to the respective account.

- Trial balance on the other hand has limited information as it is only a summary of ledger account balances at the end of the accounting period.

Purpose for preparation

- The purpose of the ledger is to collate all journal entries account wise and to determine account balances as a base to prepare the financial statements.

- The purpose of a trial balance is to verify that all debits and credits tally and serves as a check that the books are in balance.

Timing of preparation

- Ledger accounts are posted to throughout the year or throughout the accounting period.

- Trial balance is generally compiled once at the end of the accounting period to summarize the account balances.

Format

- Ledger is prepared in ‘T’ format with debits posted in the left column and credits posted to the right.

- Trial balance is prepared in a columnar format.

Balancing and tallying

- Ledgers are totaled at the end of the accounting period to determine account balances to be transferred to the profit and loss account and balance sheet. However there is no tallying of debits and credits to be done.

- The trial balance is totaled at the end of the accounting period and the debits and credits must tally.

Ledger versus trial balance – tabular comparison

A tabular comparison of ledger and trial balance is given below:

|

||||

| Meaning | ||||

| Principal book of account which is a compilation of all business transactions segregated and posted account wise | Listing of all account balances that is prepared from individual ledger accounts | |||

| Hierarchy in accounting cycle | ||||

| After journal and before trial balance | After ledger | |||

| Quantum of information | ||||

| Comprehensive – information on all transactions | Limited – only account balances | |||

| Purpose for preparation | ||||

| Calculating period end balances of all accounts to aid in preparation of financial statements | To ensure that books are in balance i.e.: total of debits equal total of credits | |||

| Timing of preparation | ||||

| Throughout the accounting period | Generally once on the last day of the accounting period | |||

| Format | ||||

| ‘T’ format | Columnar | |||

| Balancing and tallying | ||||

| Balanced but not tallied | Totaled, and tallying is a must | |||

Conclusion – ledger vs trial balance:

While both the ledger and trial balance are integral parts of a double entry accounting system cycle, they each have specific purpose and utility. Ledger forms part of the base books of accounts and are available to accountants and auditors to track business transactions. Ledgers are not available to investors though and it is the trial balance and financial statements that are available to investors to study the financial position of a business.