A manufacturing entity incurs a plethora of costs while running its business. While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability. Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis.

This article looks at meaning of and differences between two main cost categories for a manufacturing entity – manufacturing cost and non-manufacturing cost.

Definitions and meanings

Manufacturing costs:

Manufacturing cost is the core cost categorization for a manufacturing entity. It encompasses the costs that must be incurred so as to produce marketable inventory. Entities may manufacture several types of products and the sum total of all the costs involved in producing those products is termed as manufacturing cost.

The formula for calculating the total manufacturing cost is:

Manufacturing costs = Cost of direct materials + Cost of direct labor + All manufacturing overheads

The three components of manufacturing cost formula presented above are briefly described below:

- Direct materials cost includes all materials and supplies that are used as input in the production process and whose usage can be directly traced to the final product(s) manufactured by the entity. It primarily include raw materials and packing materials. The fabric, buttons, thread, packing boxes etc. used by a manufacturer of garment products are all examples of direct materials. Similarly, the total cost of fruit pulps, sugar, flavors, and food preservatives used by Mitchells food factory to produce various varieties of jam is also an example of direct materials cost.

- Direct labor cost includes the wages and all other monetary benefits paid out to those personnel who work in the manufacturing process and whose work can be directly traced to the products manufactured. In a garment factory, the sum of all the wages and benefits paid to pattern cutters, tailors, sewing machine operators, folders and packers is an example of direct labor cost.

- Manufacturing overheads include all other costs involved in the manufacturing process but that cannot be directly traced to the final products. These can include rent of factory, depreciation of factory building, depreciation of plant and machinery, insurance and maintenance costs related to plant and machinery and costs associated with factory maintenance staff etc.

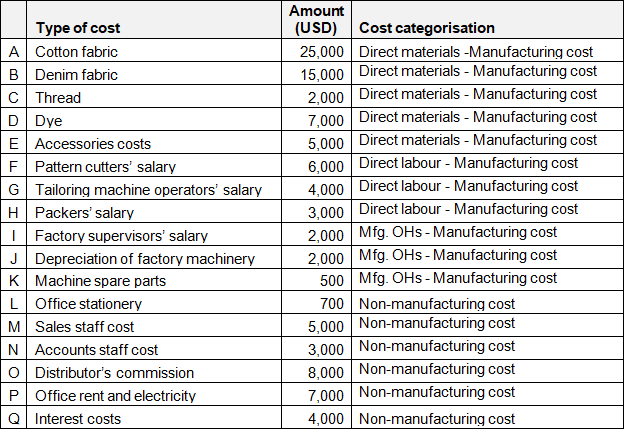

Example: Maria Inc. manufactures readymade garments. It has incurred the following costs for the month of March 2021:

According to above table, Maria Inc’s total manufacturing cost incurred during March 2021 consists of item “A” to item “K” and can be calculated as follows:

Manufacturing cost = (Direct materials) + (Direct labor) + (Manufacturing overhead)

= *($54,000) + **($13,000) + ***($4,500)

= $71,500

*(A + B + C + D + E)

= ($25,000 + $15,000 + $2,000 + $7,000 + $5,000)

= $54,000

**(F + G + H)

= ($6,000 + $4,000 + $3,000)

= $13,000

***(I + J + K)

= ($2,000 + $2,000 + $500)

= $4,500

Non-manufacturing costs:

Non-manufacturing costs include those costs that are not incurred in the production process but are incurred for other business activities of the entity. These costs do not specifically contribute to the actual production of goods but are essential to ensure overall functioning of the business.

Non-manufacturing costs generally include:

- Selling and distribution costs – sales staff salary, logistics and transportation costs, freight and carriage costs etc.

- Marketing and advertising costs – marketing campaign costs, advertising agency fees etc.

- Finance costs – interest charges on loans and advances obtained from other entities or institutions etc.

- Office and administrative costs – accountants’ salaries, office electricity, stationery costs, office executives’ salaries etc.

Continuing the same example given above under manufacturing cost, the total non-manufacturing cost of Maria Inc. for the month of March 2021 consists of item “L, M, N, O, P, Q” and can be computed as follows:

Non-manufacturing cost = L + M + N + O + P + Q

$700 + $5,000 + $3,000 + $8,000 + $7,000 + $4,000

= $27,700

Difference between manufacturing and non-manufacturing costs

The nine key points of difference between manufacturing and non-manufacturing costs have been detailed below:

1. Meaning

- Manufacturing costs comprise of all costs that are incurred in the manufacturing process and are imperative to produce finished goods.

- Non-manufacturing costs comprise of all other costs incurred by the manufacturing entity on activities apart from its core manufacturing process.

2. Cost types included

- Manufacturing costs include the cost of direct materials, direct labor and manufacturing overheads.

- Non-manufacturing costs include administrative costs, marketing and selling costs, finance costs etc.

3. Nature

- Manufacturing costs are the core and primary cost for a manufacturing entity.

- Non-manufacturing costs are ancillary and secondary costs for a manufacturing entity.

4. Quantum

- Manufacturing costs being the core costs generally constitute a majority proportion of the entity’s total costs.

- Non-manufacturing costs, on the other hand, typically constitute a lower share of the entity’s total costs.

5. Type of entity

- Manufacturing costs are incurred only by manufacturing entities.

- Non-manufacturing costs are incurred by all type of business entities – entity can be a manufacturing, trading or service entity.

6. Financial accounting treatment

- Manufacturing costs are accounted for as cost of goods sold in the trading account and impact gross profit of the entity.

- Non-manufacturing costs are accounted for in the general profit and loss account and impact the net profit of the entity.

7. Part of cost of goods sold

- Manufacturing costs form part of cost of goods sold and are carried as part of inventory in the balance sheet till the inventory is sold out.

- Non-manufacturing costs do not form part of cost of goods sold, but are expensed out as period costs in the period of incurrence.

8. Cost accounting treatment

- Manufacturing costs are directly attributed to the products manufactured (except manufacturing overhead component which is allocated using some appropriate allocation base).

- Non-manufacturing costs cannot be directly attributed to the products manufactured.

9. Examples

- General examples of manufacturing cost include raw materials, packing materials, wages of assembly line workers, packing staff salary, factory rent, factory depreciation, supervisors and production managers’ salaries etc.

- General examples of non-manufacturing cost include salary of office staff, accounting staff, general housekeeping staff, salesmen, advertising expenses, transport and logistics costs etc.

Conclusion:

The key difference between manufacturing and non-manufacturing costs is that the former bear the core importance for a manufacturing business and are basically incurred to produce finished goods while the latter bear the ancillary importance and are incurred in areas other than production processes. Manufacturing costs initially form part of product inventory and are expensed out as cost of goods sold only when the inventory is sold out. Non-manufacturing costs, on the other hand, never get included in inventory rather are expensed out immediately as incurred. This is why the manufacturing costs are often termed as product costs and non-manufacturing costs are often termed as period costs.

Manufacturing and non-manufacturing costs together form total costs for a manufacturing entity. They are impacted by different factors and thus their appropriate categorization is important. Manufacturing cost overruns indicate production inefficiency whereas non-manufacturing cost overruns indicate inefficiency in other areas of operations. Each of them requires a different set of cost control measures, making appropriate cost categorization even more essential.