The core cost area for a manufacturing entity is its product cost which encompasses all costs incurred in respect of entity’s manufacturing activities. The correct measurement and analysis of product costs is important as it facilitates several actions like setting the base for product pricing as well as effectively controlling costs to maximize profits. Product costs are further categorized to facilitate in-depth and accurate cost control and management.

This article looks at meaning of and differences between two categorizations of product cots – prime cost and conversion cost.

Definitions and explanations

Prime cost

Prime cost includes those costs that are directly related to manufacturing as well as are directly traceable to the products manufactured. These costs thus include only direct costs and are a core part of the total product cost.

The formula for calculating prime cost is:

Prime cost = Cost of direct materials + Cost of direct labor

Direct materials include all tangible goods or supplies that are directly used in the production process and whose presence can be directly traced to the products manufactured. As they are directly traceable, the quantum of direct materials utilized for each product manufactured can be fairly easily determined. For example, raw materials and packing materials such as leather, soles, packing boxes for a shoe manufacturer and wood for a furniture maker etc.

Direct labor costs include the wages and other benefit costs of all personnel who work directly in the production process and whose efforts can be directly traced to the products manufactured. For example, wages and other costs related to machine operators, assembly line workers and packers etc.

Aggregation of prime costs is useful for evaluating efficiency of material usage as well as efficacy of working of direct labor.

Numerical example

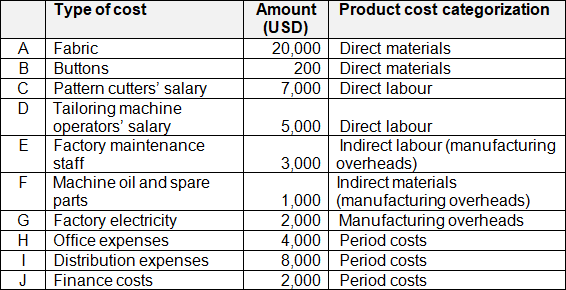

Elizbeth Inc. manufactures readymade garments. It has incurred the following costs for the month of May 2021:

According to above table, Elizbeth Inc’s prime cost can be calculated as follows:

Direct materials + Direct labor

= (A + B) + (C + D)

= ($20,000 + $200) + ($7,000 + $5,000)

= $20,200 + $12,000

= $32,200

Conversion cost

Conversion cost includes all costs incurred by a manufacturing entity to convert its raw materials into saleable finished goods. The incurrence of these costs is essential to ensure the completion of product manufacturing.

The formula for calculating conversion costs is:

Conversion costs = Cost of direct labor + Manufacturing overheads

Direct labor cost is the same as it has been referred to in the above paragraphs under prime cost.

Manufacturing overheads include all product costs other than direct materials and direct labor. These are the expenses that must be incurred to keep manufacturing operations afloat but cannot be directly traced to a specific product or process. For example, these can include factory rent, plant insurance, indirect manufacturing materials, indirect labor involved in manufacturing process and annual depreciation charge for plant and machinery etc.

Numerical example

Continuing the same example above, the conversion cost of Elizbeth Inc is:

Direct labor + Manufacturing overhead

= (C + D) + (E + F + G)

= ($7,000 + $5,000) + ($3,000 + $1,000 + $2,000)

= $12,000 + $6,000

= $18,000

Notice that the costs against items H, I and J have not been made part of any of prime cost or conversion cost computations. This is because these items are Elizbeth Inc’s period costs and don’t relate to its manufacturing process.

Difference between prime cost and conversion cost

The difference between prime cost and conversion cost have been detailed below:

1. Meaning

- Prime costs are all direct costs involved in manufacturing process which directly correlate to goods manufactured.

- Conversion costs, as the name implies, are all costs that must be incurred so as to transform raw materials into finished goods.

2. Formula/inclusions

- Prime costs include cost of direct materials used and cost of direct labor employed.

- Conversion costs include cost of direct labor employed and all manufacturing overheads incurred.

3. Traceability to final product

- All prime costs have a direct one-to-one relation with products manufactured and can be directly traced to a specific product or products. For example, for a garment manufacturer, the quantum and cost of fabric used and man-hours and machine hours required to produce each type of garment can be specifically identified.

- All conversion costs cannot be directly traced to products manufactured. The overhead component of total conversion cost is an indirect cost component and, thus, cannot be specifically traced to a particular product.

4. Nature of costs

- Prime costs are mostly variable in nature as they vary in direct proportion to the level of output.

- Conversion costs can be partially semi-variable or fixed as cost of manufacturing overheads do not necessarily vary directly with level of output. For example, factory building rent may remain the same irrespective of the level of output produced during the relevant period.

5. Cost determination

- As prime cost has a one-to-one relationship with finished goods, measuring and calculating such costs is fairly simple.

- Determination of conversion costs is more complex as it includes overheads that need to be aggregated and allocated across products based on established and appropriate cost drivers.

6. What impacts the cost

- Prime cost is primarily impacted by two factors that are issues related to materials supply chain and issues direct labor and its efficacy.

- Conversion cost on the other hand can be impacted by several factors such as market property rates impacting rental, machinery wear and tear level impacting depreciation, machine usage efficacy impacting maintenance costs and direct and indirect labor efficacy etc.

7. Examples

- Examples of prime costs for a shoe manufacturer include leather, rubber, shoelaces, wages of all labor involved in assembly line and packing.

- Apart from direct labor costs as above, examples of conversion costs for the same show manufacturer, include rent of factory building, indirect factory staff such as production manager, housekeeping staff, security and factory electricity etc.

Conclusion:

The key difference between prime cost and conversion cost is that the former is the aggregation of all direct costs and typically include direct materials and direct labor while the latter is the total of all costs incurred to convert direct materials into its salable finished goods form and typically include direct labor and manufacturing overhead. In this regard, direct labor cost becomes the common component of both the cost categories. Prime cost, in its entirety, is traceable to the product manufactured as both of its individual components (i.e., direct materials + direct labor) are direct and traceable. Conversion cost, on the other hand, is not traceable to the product in its entirety because of having a non-traceable component (i.e., manufacturing overhead) in its total.

Both prime costs and conversion costs are sub-categorizations of product or manufacturing costs. These cost concepts are primarily found in manufacturing entities as other entities such as trading entities and service entities do not deploy direct materials and labor to produce finished goods.

The principal management functions that can be facilitated through these cost categorizations include tracking costs, assessing wastages, realizing inefficiencies, controlling them through timely cost control policies and accurate product pricing