The businesses, especially growing companies require funds from time to time. At start up phase or when internally generated funds are insufficient, the companies may need to rely on external sources. This can include raising share capital of different types to avail various types of funding. The sum total of a company’s share capital along with all outstanding debt instruments forms its capital structure. Essentially, the manner in which an entity raises funds is identifiable from its capital structure reported in its balance sheet.

This article looks at meaning of and differences between two types of capital structure that a company may have – simple and complex capital structure.

Definitions and meanings

Simple capital structure

A simple capital structure is one wherein a company’s capital does not consist of any securities that have the potential to dilute the earnings available to its shareholders.

Such capital structure generally consists of equity shares and non-convertible preference shares. It may also include external debt, provided that such debt does not have any clause that allows it to be converted, at any later stage, into equity shares of the company. The inclusion of a convertible security converts the simple capital structure into a complex one due to its dilutive impact on earnings per share (EPS) of the company.

Simple capital structures are generally found in smaller promoter run companies that rely more on funds provided by their existing shareholders rather than by varied external parties.

Example:

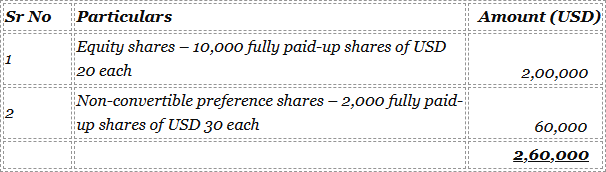

Maria Inc. has the following capital structure:

As none of its capital components can be subsequently converted into equity shares to dilute the EPS, Maria Inc. has a simple capital structure in its balance sheet.

Complex capital structure

A complex capital structure is one in which a company’s capital consists of, in addition to regular equity shares, securities that are convertible and thus have a potentially dilutive effect on the earnings available to shareholders.

This capital structure can consist of various classes of securities which can include the following:

- Equity shares

- All types of preference shares

- Convertible and non-convertible debentures/bonds

- All types of warrants

- Outstanding stock options

Generally, the larger companies and those that approach external investors for their funding needs are found to have complex capital structures. In order to attract different types of investors, such companies are often compelled to offer different types of investable securities bearing varied rights and obligations. For example, venture capitalists may often insist that preference shares issued to them have a convertible option. Investors may exhibit their interest to invest through bonds if they have a clause allowing them to be converted into participating equity at a later stage.

The companies maintaining employees stock option plans (ESOPs) can also have a complex capital structure on account of any of their outstanding stock options. Under stock option plans, company employees are entitled to buy equity shares at certain fixed price, generally on the fulfilment of certain conditions. Since an outstanding stock option has a potentially dilutive impact on entity’s earnings, its existence would cause analysts to consider that the entity has a complex capital structure.

Example:

Continuing the example above, Maria Inc. is in need of additional funds for large-scale expansion of its factory. For this, it approaches outside investors. A venture capitalist, namely, John Inc. agrees to provide funds amounting to $500,000 in exchange of the following:

- Convertible preference shares of $300,000 (10,000 shares with $30 fair value), with the option to be converted into equity shares after 5 years.

- Convertible debentures of $200,000 @ coupon rate of 10% for 5 years, with a clause to convert to equivalent equity shares at the end of the tenure.

With the inclusion of above convertible securities, Maria Inc. now has a complex capital structure.

Difference between simple and complex capital structure

The six main points of difference between simple and complex capital structure have been listed below:

1. Meaning

- A simple capital structure is a capital structure which consists of only equity shares or other non-convertible securities that have no dilutive effect on the company’s earnings per share.

- A complex capital structure is a capital structure which has several classes of securities which include convertible instruments that can potentially dilute the company’s earnings per share.

2. Components

- A simple capital structure consists of equity shares, non-convertible preference shares and simple non-convertible debt such as bank borrowings etc.

- In addition to the above, a complex capital structure also consists of securities such as convertible preference shares, convertible debentures or bonds, convertible share warrants, and outstanding employee stock options etc.

3. Impact on earnings per share (EPS)

- A simple capital structure will not result in any dilutive effect on the company’s earnings available to shareholders.

- A complex capital structure will have a potentially dilutive effect on the company’s EPS i.e., whenever the convertible securities convert into equity shares they dilute the earnings available to shareholders.

4. EPS calculation and disclosure

- A company with a simple capital structure is required to calculate and report only basic EPS in its financial statements.

- A company with a complex capital structure is required to calculate and report both basic and diluted EPS in its financial statements.

5. Investor types

- A company with a simple capital structure will generally have promoter equity shareholders and a simple lender profile such as banks etc.

- A company with a complex capital structure tends to have several types of investors with differing rights and obligations based on the type of investment security that they hold in the company.

6. Opted for by

- A simple capital structure is preferred and financed by promoter run companies.

- A complex capital structure is opted for by larger companies or companies that have to offer varied instruments to attract investors for their high value fund requirements.

Conclusion

The key point of difference between a simple and a complex capital structure is that the former does not have any convertible securities in its total whereas the latter contains one or more convertible securities as its component. A security is regarded as convertible when it is privileged by the issuing entity with the right to be converted into common or equity shares, in accordance with certain preagreed terms. If conversion feature attached with the security is exercised by the holder, the security may dilute (reduce) the entity’s earnings per share (EPS).

Most successful companies today can eventually evolve from having a simple capital structure to a complex capital structure. Companies mostly tend to begin with a simple capital structure and are financed by their promoter group through common equity shares. With the passage of time, their business grows and so their funding needs, for which they often need to approach external investors with varying investment preferences. To manage this, the entities opt for different types of financing by issuing a variety of convertible securities, which evolves their simple capital structure to a complex one.