Cash and bank transactions take place almost daily in any business entity. In fact, these transactions also take place at high volumes. Correct accounting for these transactions is important as it reflects the company’s liquidity position and helps management manage their cash flow. Business entities use a dedicated subsidiary book termed as the ‘cash book’ to record its cash-based transactions. The cash book serves as both a journal and a ledger. This is because it serves as the book of original entry for the cash-based transactions as well as determines cash/bank balances akin to a ledger account.

This article looks at meaning of and differences between two types of cashbooks that are generally prepared in businesses – single column and double column cash book.

Definitions and meanings

Single column cash book:

A single column cash book is the subsidiary book in which an entity accounts for all its cash-based transactions. A single column cash book records only those transactions that impact the inflow or outflow of actual physical cash in hand. It thus does not record bank transactions that do not have an impact on the cash in hand.

The following types of transactions are recorded in a single column cash book:

- Cash receipt – can be on account of cash sales, receipt of cash on account etc.

- Cash payments – can be on account of cash purchases or payment of other expenses in cash

- Deposit of cash in hand into a bank

- Withdrawal of cash from a bank

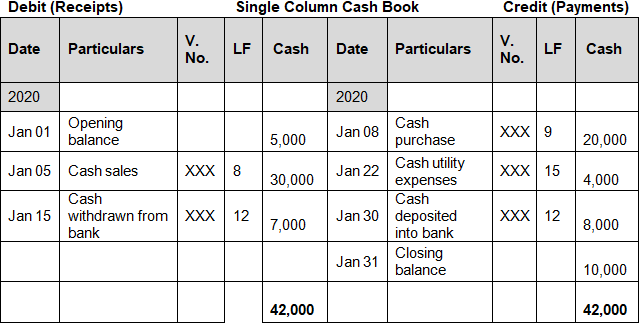

A single column cash book is prepared in a T format with debit (cash inward) transactions recorded on the left and credit (cash outward) transactions recorded on the right. It generally has the following columns on either side:

- Date

- Particulars – describing nature of transaction

- Voucher reference number

- Ledger folio number – ledger account number to which the other effect of transaction is posted

- Cash amount – inflow on debit (or receipts) side and outflow on credit (or payments) side

Example

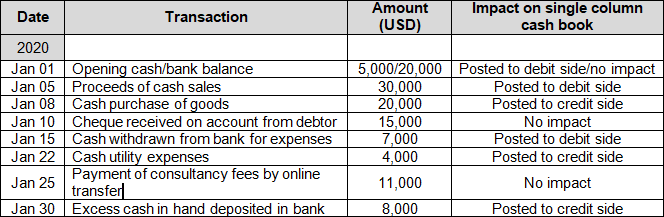

The following transactions take place in the month of January 2020 for ABC Inc:

The single column cash book has been prepared below:

An entity that prepares a single column cash book does not need to prepare a separate cash ledger account. The balance of cash in hand reflected in the single column cash book is compiled into the trial balance.

Double column cash book:

A double column cash book is the subsidiary cash book that records both cash and bank-based transactions. It thus accounts for all transactions that have an impact on the cash flow of the business, either by way of changes in cash balance or bank balance.

In addition to the entries recorded in a single column cash book, the double column cash book records the following type of transactions:

- Bank receipts – can be cheque deposits, cash deposits or inward online transfers.

- Bank payments – can be cheque payments, cash withdrawals or outward online transfers.

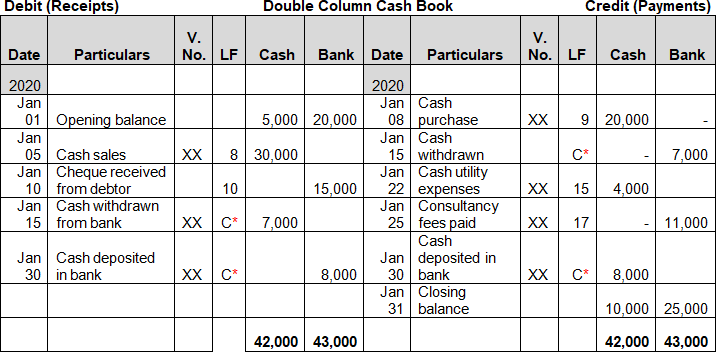

It is thus essentially an extension of a single column cash book as it has one additional column for recording bank transactions.

Continuing the same example as above, the double column cash book will be prepared as follows:

*A contra entry involves a recording of transaction on both receipts (i.e., debit) and payments (i.e., credit) sides of the book. Such an entry is passed each time when a business deposits or withdraws cash from account maintained with a bank.

Difference between single column and double column cash book

The difference between single column and double column cash book are as follows:

1. Meaning

- A single column cash book is a subsidiary book that records all cash receipt and cash disbursement transactions.

- A double column cash book is a subsidiary book that records all cash and bank-based transactions.

2. Type of transactions recorded

- A single column cash book records only those transactions that involve exchange of actual cash in hand.

- A double column cash book records all transactions, that takes place either through exchange of actual cash or through the bank.

3. Balances reflected

- A single column cash book reflects the balance of cash in hand.

- A double column cash book reflects the balance of both cash in hand and balances with banks.

4. Reconciliation

- The balance reflected by a single column cash book is reconciled with actual physical cash in hand.

- The balance reflected by a double column cash book is reconciled with both actual cash in hand and bank statements. A bank reconciliation statement is prepared for this.

5. Comprehensiveness

- A single column cash book gives a limited snapshot of cash balance available with an entity on any given date.

- A double column cash book on the other hand gives a more complete picture of the entity’s liquidity position as it reflects all those transactions that impact cash flow.

6. Contra entry

- As no bank transactions are recorded, a single column cash book does not record a contra entry.

- Each time the cash is deposited into or withdrawn from bank, a contra entry is essentially recorded in a double column cash book. In our example, the transactions occurred on January 15 (withdrawal) and January 30 (deposit) have been recorded on both sides of double column cash book because they involve in a bank deposit and withdrawal.

Conclusion – single column vs double column cash book:

In today’s age of digital business where majority of transactions take place online, the double column cash book assumes additional importance. As it is likely that a larger volume of transactions take place through the bank, entities could prefer to prepare a double column cash book rather than only a single column cash book so as to give a better overall picture of the entity’s liquidity.