Financial statements are prepared for various stakeholders (both internal and external) to gauge the financial performance as well as the entity’s financial health for a specific period. Financial statements largely consist of income statement, cash and fund flow statements and balance sheet. The income statement reports all the revenues and expenses of the business for the specific accounting period so as to arrive at the net profitability for the period. Revenues and expenses can be bifurcated in different manners such as fixed and variable, direct and indirect, department wise etc. The manner in which the revenues and expenses are presented in the income statement determines the type of income statement prepared.

The article “traditional vs contribution margin income statement” looks at meaning of and differences between two types of presentation of income statements – traditional income statement and contribution margin income statement.

Definitions and meanings

Traditional income statement

The traditional income statement is a profitability statement that bifurcates and reports revenues and expenses on the basis of their relation with production activity i.e., direct and indirect. It reports two levels of profit:

- Gross profit that reflects the difference between production related revenues and expenses; and

- Net operating income that reflects the residual profit after consideration of gross profit and other indirect revenues and expenses.

Effectively, this income statement can be bifurcated into a manufacturing or trading account which reports the gross profit and the profit and loss account which reports the net profit or net operating income.

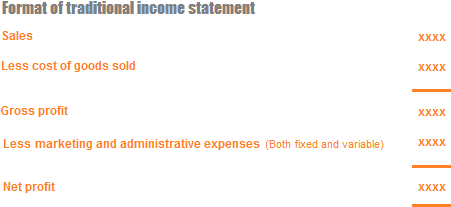

Format:

The simplest format of a traditional income statement looks like the following:

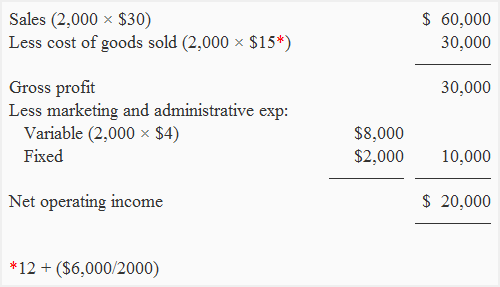

Example:

Roberts, a single product company, has earned the following revenues and incurred the following expenses for the year 2020:

Revenues realized during 2020:

- Units manufactured and sold during 2020: 2,000 units

- Sale price: $30 per unit

- Total sales revenue realized: (2,000 units × $30): $60,000

Expenses incurred during 2020:

- Variable manufacturing expenses: $12 per unit

- Variable selling and administrative expenses: $4 per unit

- Fixed manufacturing expenses: $6,000 per month

- Fixed marketing and administrative expenses: $2,000 per month

Roberts has no finished goods and work in process inventory.

The traditional income statement prepared for the above would be as follows:

The above is an example of a traditional income statement prepared in a columnar format. The same can also be prepared in ‘T’ form.

Contribution margin income statement

The contribution margin income statement is a profitability statement that reports the entity’s contribution margin and net operating income, by bifurcating expenses on the basis of their variability. The key point to note here is that the expenses are bifurcated into fixed and variable and accordingly reported in the income statement.

This statement reports two levels of profit:

- Contribution margin which is arrived at by deducting all variable expenses from the total revenue.

- Net operating income which is arrived at by deducting all fixed expenses from the contribution margin.

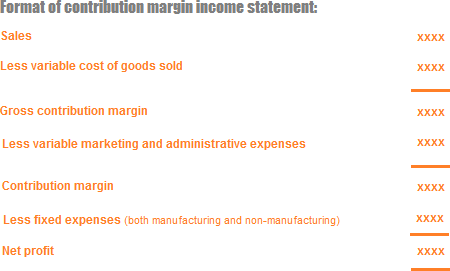

Format

Below is the simplest format of a contribution margin income statement:

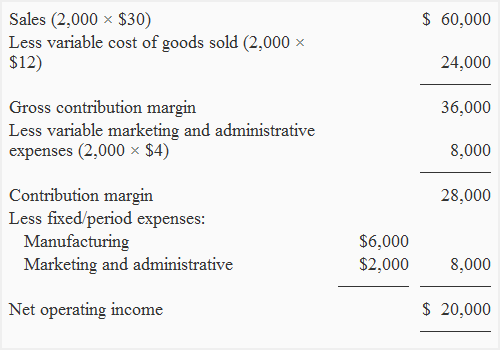

Example

Continuing with the above revenue and expense data of Roberts Company, the contribution margin income statement can be prepared as follows:

While the net profit in this example is the same for both types of income statements, this may not always be the case. In circumstances where opening and closing inventory differ, the net profit reflected in both the income statements would also differ. This is on account of charge of fixed costs. While the entire fixed cost incurred in the period would be charged in the contribution margin statement, the same would be adjusted for opening and closing inventories in the traditional income statement.

Difference between traditional and contribution margin income statement

The eight points of difference between traditional and contribution margin income statement have been detailed below:

1. Meaning

- Traditional income statement reports the profitability of the entity at gross and net levels i.e., profitability attributed to its production related activities as well as overall profitability from all activities.

- Contribution margin income statement reports the contribution that the entity’s income makes towards fixed costs as well as the overall profitability after recording of all fixed costs.

2. Bifurcation of

- The traditional income statement bifurcates both incomes and expenses on the basis of their relation to production activities.

- The contribution margin income statement bifurcates only expenses of the entity. All incomes are clubbed together.

3. Bifurcation basis

- Traditional income statement follows absorption costing basis wherein incomes and expenses are bifurcated into direct and indirect.

- Contribution margin income statement follows variable costing basis wherein expenses are bifurcated on the basis of their variability i.e., their relationship with changes in output levels.

4. Nature of reporting

- Traditional income statement is reported externally and forms part of published financial statements.

- Contribution margin income statement is reported internally within the entity and does not form part of published financial statements but part of MIS reports.

5. Reported for benefit of

- Traditional income statement is reported primarily for the benefit of external stakeholders such as shareholders, other investors, creditors, bankers etc.

- Contribution margin income statement is reported primarily for the benefit of the management.

6. Statutory requirement

- Traditional income statement is mandatorily required to be prepared and reported as per jurisdictional laws.

- Contribution margin statement is not a statutorily required report but is prepared for internal managerial use.

7. Subject to audit

- Traditional income statement, being part of reported financial statements is mandatorily subjected to external audit.

- Contribution margin income statement is not subject to any external audit.

8. Utility

- Traditional income statement is utilized for gauging profitability as well as efficiency of the entity’s production and other activities.

- Contribution margin income statement is utilized for management analysis to aid decision making on pricing and cost control.

Conclusion – traditional vs contribution margin income statement:

All business entities prepare traditional income statement as it is the base document for gauging profitability. Several business entities may also choose to prepare contribution margin income statement, especially when they have several product lines as it lends itself to more detailed analysis that assists management on critical decision making.