A proper management and control over costs is crucial to maintain and grow profits which is the primary objective of every commercial business. The first step in achieving this is to understand the nature of costs that a business incurs while carrying out its operations as well as the factors affecting those costs.

Variable cost is one key categorization of total costs incurred in a business unit. Every cost that explicitly changes with a change in the level of output or another business activity qualifies to be a variable cost. Within variable costs as well, there are different cost categorizations based on their relationship with level of output.

The article “true variable vs step variable cost” looks at meaning of and differences between these two types of variable costs – true variable cost and step variable cost.

Definitions and meanings

True variable cost

True valuable costs are those variable costs that have a direct and one to one relationship with output levels of a business. In other words, these costs are directly proportionate to output and change with every change in output level. So, if for every single unit increase in output, a particular cost element also increases by a specific quantum then this cost would qualify as a true variable cost.

As these costs vary directly in proportion to the level of production, they would not be incurred in situations where production level is zero.

Example: Direct materials is a classic example of true variable cost. Suppose, for example, a corporation named ABC Inc. manufactures commercial vehicles. A large part of its costs includes direct material costs such as metal frames, tyres and car accessories. Every commercial vehicle manufactured requires a specific amount of these direct materials. Hence for every additional vehicle manufactured, these direct material costs will also increase proportionately. Conversely, if no vehicles are manufactured, these costs would not have to be incurred.

Step variable cost

Step variable cost is also a subtype of variable cost that remains the same up to a particular level of output and increases once that particular output level is breached. These costs also vary with the level of output but they have a staggered relation with the level of output.

For example, a cost can be say $100 up to 500units, increase to $185 for 501 to 1,000 units and to $260 if output crosses 1,000 units. The cost with such a pattern of increase would be classified as step variable cost. This means that the cost would remain the same whether 1 unit or 500 units are produced, it would increase once the 501st unit is produced till 1,000 units and would increase further once the 1001st unit is produced. This behavior of such cost give it its name “step variable cost”.

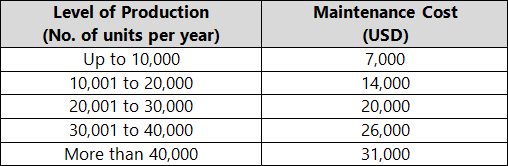

Example – (continuing the above example of ABC Inc. under the true variable cost explanation): ABC Inc. also incurs maintenance cost on its machines. These are contractual costs that are incurred on output milestones, as follows:

Maintenance costs will thus increase with every 10,000 unit increase in production levels. This is thus an example of step variable cost.

Difference between true variable and step variable cost:

Some main points of difference between true variable and step variable cost have been listed below:

1. Meaning

- True variable costs are costs that increase or decrease in direct proportion to increase or decrease in the level of production/activity of an entity.

- Step variable costs are costs that are incurred at a particular amount up to a specified level of output and increase only once output levels exceed the specified level.

2. Cost behavior

- True variable costs are directly proportionate to output levels and thus behave only as pure variable costs.

- Step variable costs on the other hand have characteristics of both fixed and variable costs. These costs are fixed at an amount up to a particular output level and behave like a variable cost once particular output level is breached.

3. Graphical presentation of cost behavior

- True variable costs have a linear graphical representation as they are directly proportionate to output levels.

- Step variable costs represented graphically, remain horizontal up to a specific level then increase after this level. This behavior repeats at each output threshold level giving the graphical representation a step like appearance.

4. At zero level of production

- True variable costs are not incurred at zero levels of production. For example, if production is halted, materials will not be required and hence this cost will not be incurred.

- Step variable costs may continue to be incurred at zero levels of production. For example, even if production is halted, minimal maintenance cost for upkeep of machines may need to be incurred.

5. Increase quantum

- True variable costs increase on a per unit basis; hence every increase is in a smaller and systematic proportion.

- Step variable costs increase only on increase in outputs beyond certain levels hence they increase by larger lumpsum amounts.

6. Impact on per unit costs

- The per unit cost of true variable costs remain the same irrespective of the level of output.

- The per unit cost of step variable costs keep decreasing up to a certain level of output, once this level is crossed the per unit cost can increase significantly and once again starts decreasing as the output levels rise.

7. Examples

- Examples of true variable costs include raw material costs, transport costs etc.

- Examples of step variable costs include maintenance costs, cost of shop floor supervisors, cost of employees servicing customers in hospitality industry etc.

Conclusion – true variable vs step variable cost:

Understanding the nature and behavior of a particular cost element is much important for managers in exercising their decision making function. Once a cost is correctly categorized, effective cost control and cost management policies can be devised and implemented successfully.

A certain cost may have a key impact on overall profitability. For example, a step variable cost may have a considerable impact on profitability if production increases across a certain level which can significantly increase costs without a commensurate increase in sales. This understanding and analysis of cost behavior is of great importance for management to take decisions regarding production and other activities that may have a core impact on cost.