Minimizing costs and maximizing sales are two prime management aspects that commercial entities need to focus on for maximizing their profits. The control and management of cost is, therefore, one of the chief functions for all commercial entity. It involves adoption of several techniques by the management in a bid to manage and lower costs. If costs are not effectively controlled, frequent cost over runs may occur which would adversely affect the profitability as well as the commercial viability of the enterprise. Cost control involves several steps including planning, communicating of plans, variance analysis and ultimately decision making to manage reported variances.

This article looks at meaning of and differences between two key tools that are an important part of the first step of cost control (i.e., planning) – standards and budgets.

Definitions and meanings

Standards

A standard is a benchmark that is established to form the basis for cost variance analysis. In the context of cost and management accounting, a standard is essentially the pre-established quantity or cost of input(s) required to manufacture a unit of a product or to provide a particular service. Standards are used as the basis of comparison with actual costs or volumes in variance analysis.

Standards are part of the planning stage of cost control. They are typically set for all cost components of a particular product or process. For example, in a manufacturing entity, a standard will be set for the per unit direct materials cost, per unit direct labor cost and per unit overhead cost for each individual product the entity manufactures.

Setting and application of standards form the basis of standard costing system. After standards are established, the standard costs are compared with the actual costs incurred and variances between the two are computed and identified. Management attention is then drawn to any unfavorable variances for investigating into the causes and taking the corrective actions to control costs.

Example:

ABC Inc. manufactures air-conditioners. As per established industry norms and the company’s historical costs, the standards have been set per unit as follows:

- Standard material cost: $75

- Standard direct labor: 8 man hours @ $10 per hour

- Standard overheads: $50

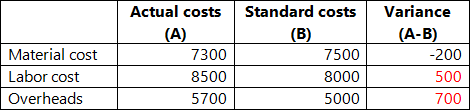

In the month of March 2021, ABC Inc. incurs the following actual costs in producing 100 AC units:

The labor cost and overheads have overrun the standards set. These variances are analyzed for their causes and corrective action is determined by management.

Budgets:

A budget is a statement of estimated incomes and expenses over a specific time period. It can be prepared for a single project or a department or for an entity as a whole.

Budget is normally prepared in the planning phase of cost control. The objective of preparation of a budget is to forecast the likely revenue streams and expense outflows for a specific time period and to implement budgetary control. The financial performance of an entity is evaluated against the prepared budget.

Example:

- The budget for the research and development (R&D) department lists out the budgeted expenses on different activities of the department for the year. Any excessive cost overruns from the budget generally would require management approval. It also assists in evaluating the costs which have exceeded the budgets and to assess the causes.

- A sales budget lists out the budgeted sales to be achieved for each product line. A more complex budget will allocate sales budget per location, per branch or per salesman etc. This budget would be helpful for evaluating the overall sales efforts made by the relevant sales personnel as well as by the entity as a whole.

Difference between standards and budgets

The seven key points of difference between standards and budgets have been listed below:

1. Meaning

- A standard is a predetermined quantity or cost of input that is established for per unit of product manufactured or service provided.

- A budget is a statement that forecasts the incomes and expenses of a department or entity over a specified time period.

2. Level for which they are set

- Standards are generally set at an individual product or process level i.e., at micro level.

- Budgets, on the other hand, are set at a more macro level such as for the entity as a whole or may be subdivided for each of its department.

3. Components

- A standard lays out the benchmark for cost aspects of a product; for example, standard direct material cost, standard overhead cost etc.

- A budget lays out financial details involving both costs and revenues; for example, the budget of an entity may lay out its estimated sales as well as the estimated costs for each of its departments.

4. Comprehensiveness

- A standard is a less comprehensive cost control tool due to its limited scope of specific cost items involved in manufacturing a product or providing a service.

- A budget is a more comprehensive cost control tool as it covers all financial aspects of a business entity in detail, right from operations to sales and administrative to managerial etc.

5. Basis of

- Standards involve the estimation of cost accounts and are the basis of standard costing.

- Budgets involve the estimation of financial accounts and are the basis of budgetary control.

6. Utility

- The key utility of setting standards is to conduct cost variance analysis with the objective of improving cost efficiency of a manufacturing process.

- The key utility of preparing budgets is to estimate incomes and expenditures that will assist in financial performance evaluation of the entity and its processes.

7. Prepared by

- Standards are generally set with the assistance of operations personnel who are privy to details of the manufacturing process.

- Setting of a budget is a more collaborative effort taken up by the management in coordination with several departmental heads and their personnel.

Conclusion – standards vs budgets

Setting of standards and budgets have the common intention of achieving cost management and cost control. Standards and budgets are mutually exclusive which means standards can be set without the need to prepare an extensive budget and budgets can be prepared without the need for detailed standard costing. In practice, however, these tools are used simultaneously. Standards focus on operations aspect of the business whereas budgets mainly focus on the financial aspect of the business.