Goods is a very wide term in economics and they can be any product or resource that has utility to a user or consumer. From an accounting perspective, however, goods typically include raw materials and supplies used in the production process, semi-finished goods or work in process and finished goods which are the final marketable products available for sale to buyers.

At every point in time, entities will be holding a specific quantity of these goods. Raw materials are held to be ready to run production, work in process is held in the production process and finished goods are held to meet demand. The aggregate of all these goods held with a manufacturing entity at any point of time is termed as its “stock”.

This article looks at meaning of and differences between two values of such stock that exist at different points of time – opening stock and closing stock.

Definitions and meanings

Opening stock:

Opening stock is the balance of all goods lying with an entity on the starting date of its accounting period. It is brought forward from the close of the preceding accounting period i.e., the opening stock of the current period would be the closing stock of the previous period.

In a manufacturing entity, the opening stock generally comprises of the following items:

- Raw materials: All the input material and supplies required in the production process.

- Work-in-process (WIP): These are the goods that are not complete and ready to sell but are at some stage of the production process. These are also termed as semi-finished goods or goods in process.

- Finished goods: Goods which have been produced and are ready for sale are named as finished goods.

If an entity follows calendar year as its accounting period, the quantity and value of stock of raw materials, WIP and finished goods lying with the entity on 1st January of each year is termed as opening stock.

Example:

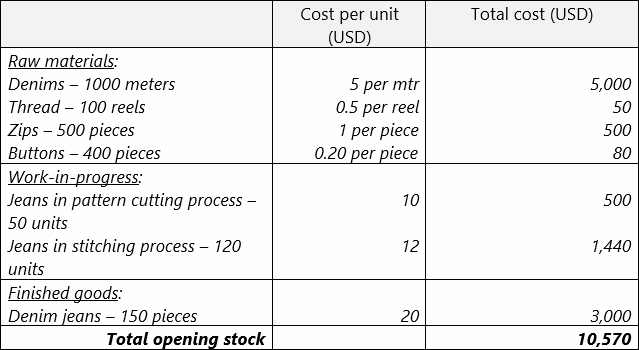

John Inc. is a jeans manufacturing company. Its opening stock as on January 1, 2021 comprises of the following items:

Opening stock is generally not separately disclosed in the income statement but forms part of cost of goods sold (COGS). It is considered in COGS calculation as follows:

Cost of goods sold = Value of opening stock + Purchases – Value of closing stock

From a business perspective, opening stock is held for preparedness to meet production or sales requirements.

Closing stock:

Closing stock is the balance of all goods lying with an entity on the closing date of the accounting period. Like opening stock, closing stock too can comprise of three components – raw material, WIP and finished goods.

At the close of accounting year, entities assess the total stock available on hand and value the same as closing stock for their accounting purposes. This closing stock goes to reduce the amount of COGS. Entities, generally, also do a physical stock taking to match the quantity as per books and the quantity that is physically available in store rooms.

Continuing the same example as above, if an entity follows calendar year as its accounting year, the quantity and value of goods available with the entity on 31st December of each year qualifies as closing stock.

There are 4 major methods used for calculating closing stock:

- First in First out (FIFO) method

- Last in First out (LIFO) method

- Average cost method

- Gross profit method

Closing stock is a current asset for the business and is disclosed as such in the balance sheet of the entity. It is also considered in the COGS formula as shown below:

Cost of goods sold = Value of opening stock + Purchases – Value of closing stock

In merchandising companies, the term stock refers to only merchandise inventory; it does not include any materials and WIP items. This is because these companies don’t manufacture, produce or process any thing, rather they buy ready to use goods form manufactures and/or vendors at large volume and sell them to their customers at retail price throgh their own outlets.

Difference between opening stock and closing stock:

Eight key points of difference between opening stock and closing stock have been listed below:

1. Meaning

- Opening stock is the value of inventory of raw materials, WIP and finished goods that an entity holds on the first day of its accounting year.

- Closing stock is the value of inventory of goods that an entity holds at the close (last day) of its accounting year.

2. Point of time

- Opening stock is measured and reported as on the first day of the accounting year.

- Closing stock, on the other hand, is measured and reported as on the last day of the same accounting year.

3. Represents

- Opening stock represents goods available for input in the production process or goods available for sale.

- Closing stock represents goods unused in the production process, semi-finished goods and finished goods remaining unsold in the inventory.

4. Accounting treatment

- Opening stock is the opening balance of the stock account as it is brought forward from the previous accounting period.

- Closing stock is the closing balance of the stock account. It goes to reduce the cost of goods sold and the balance is transferred as a current asset to the balance sheet.

5. Impact on cost of goods sold

- Opening stock value goes to increase cost of goods sold.

- Closing stock value goes to reduce the cost of goods sold.

6. Disclosure in balance sheet

- Being an opening balance, opening stock does not find place in the balance sheet of the entity.

- Closing stock has a closing debit balance and is reported as a current asset in the balance sheet of the entity.

7. Valuation complexity

- As opening stock is a brought forward balance from the previous accounting period, no separate valuation is done for it.

- Closing stock is generally valued through one of four methods – FIFO, LIFO, average cost and gross profit method.

8. Inventory check

- As opening stock is generally equivalent to closing stock of the earlier period, a physical stock taking is not done.

- Physical stock taking is generally done only for closing stock to reconcile actually available stock and stock as per books.

Conclusion:

Opening stock and closing stock is basically part of the same stock accounting process. From a business perspective, holding adequate stock is necessary for an entity to be prepared to meet production or sale demand. On the other hand, entities must also be conscious of the risks involved in holding excess stock such as high carrying costs and risk of obsolescence, damage or loss. Entities thus need to maintain the balance between these pros and cons while managing their stock in hand at any given time.