Financial reporting is an important aspect of every business entity as it is essential to gauge the financial performance and position of the entity. One of the important financial statements is the profit and loss account. Each profit and loss account reports amongst others two important parameters, what are popularly termed as ‘top line’ and ‘bottom line’. This is nothing but turnover and profit.

This article looks at meaning of and differences between these two parameters –turnover and profit.

Definitions and explanations

Turnover:

Turnover represents the total sales of products and/or services by the business entity in a specified time period.The formula for determination of turnover is as follows:

Turnover = Quantum of goods or services sold × Selling price per unit of goods or services sold

Turnover is generally the predominant component of total revenue of an entity, with other miscellaneous income comprising the balance. Turnover is recorded on the credit side (right side) of the trading account.

Turnover can be determined at two different levels – gross turnover at gross level and net turnover at net level. Gross turnover represents the total sale of goods and/or services that have been invoiced by the company. Whereas net turnover is derived by deducting amount of sales returns and sales discount from gross turnover. Net turnover gives a more accurate picture of the company’s actual revenue.

Turnover is the basis for several ratios that are used in financial analysis and reporting by management. This means that several aspects of the finances of a company such as cost, profitability etc are assessed in comparison to the turnover of the business. For example, net profit ratio is expressed as a percentage of net profit divided by turnover. So, a company may have an extremely high turnover level but if it has a low net profit ratio, it may have to focus its efforts on reducing its costs rather than merely increasing its sales.

Growth of an entity over different financial periods can be assessed by comparing turnover across the different periods.

Profit

Simply put, profit is the income earned by the company after deducting expenses from its revenue.

Profit of an entity is determined at two levels – gross profit and net profit.

Gross profit is calculated as:

Gross profit = Total sales – cost of goods sold;

Where, cost of goods sold is the sum total of all direct expenditure incurred on producing products sold

Net profit is calculated as:

Net profit = Gross profit – all other operating and other indirect expenses

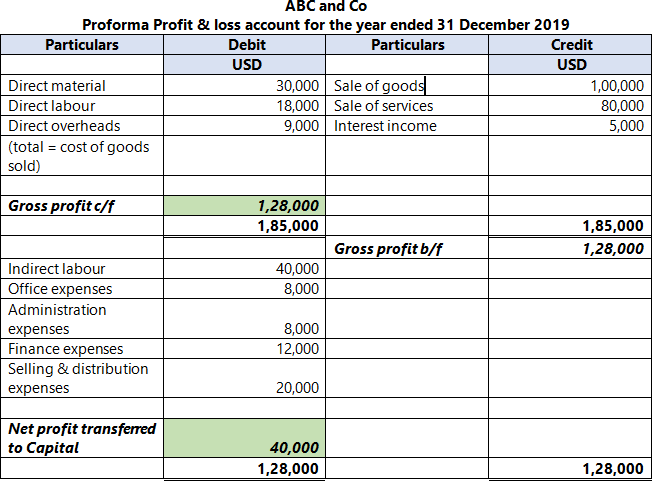

A proforma profit and loss account that discloses both gross profit and net profit is detailed below:

Profit is an indicator of financial health of a business entity. It is relevant to all stakeholders of the entity. Management relies on this indicator to assess performance of the company to determine policy decisions to be taken to increase the profit. Creditors such as suppliers and lenders use this indicator to assess the ability of the entity to make payments. Investors use this indicator to assess the profit potential of their investments in the entity.

Difference between turnover and profit

The differences between turnover and profit have been detailed below:

1. Meaning

- Turnover is the total revenue earned from sale of products and/or services by an entity.

- Profit is the income earned by the company after considering deduction of total expenses from total revenue of the entity.

2. Sequence of

- Turnover is determined first while drawing up financial statements. It is also known as top line as it appears first.

- Profit is determined subsequently, after recording turnover, other income and all expenses. It is also known as bottom line as it is derived and recorded at the end.

3. Measure of

- Turnover is an indicator of growth of an entity. It is a measure of efficacy of the sales and marketing efforts of an entity towards achieving growth in sale of products and services.

- Profit is a measure of efficiency of cost management of an entity across all departments.

4. Quantum

- Turnover is the sum total of all sales and is thus generally higher in quantum than profit (unless other income of an entity far exceeds its turnover). Turnover cannot be negative.

- Profit is the amount remaining after deducting expenses from total revenue of the entity. It is generally lower than turnover. Profit can be positive or negative (i.e., profit or loss).

5. Aspects

- Turnover considers only the revenue aspect of the company’s operations.

- Profit considers both revenue and expense aspect of the company’s operations.

6. Indicator of financial health

- Turnover is an indirect means of assessing an entity’s performance, as it is used as a basis for several analysis ratios. Looking at turnover individually may not provide the most accurate picture of the financial health of a company.

- Profit is a more direct indication of how well an entity is doing. It indicates how well the entity is managing its costs within a certain level of revenue. It is useful for all stakeholders of the entity.

7. Reporting in financial statements

- Turnover is reported on the credit side of the trading account.

- Profit is a figure derived from the profit and loss account. It is disclosed on the debit side as a balancing figure in case of a positive amount and on the credit side as a balancing figure in case of a negative amount. The profit is then transferred from the profit and loss account to the capital account in the balance sheet of the entity.

8. Formula to calculate

- Turnover is derived by multiplying sales price by quantum of sales.

- Profit is derived by deducting expenses from revenue.

Turnover versus profit – tabular comparison

A tabular comparison of turnover and profit is given below:

|

||||

| Meaning | ||||

| Total revenue collected by the entity from sale of goods to customers or provision of services to clients. | The income earned by the entity after deducting expenses from the collected revenue. | |||

| Sequence of | ||||

| Determined first – top line item | Determined subsequently – bottom line item | |||

| Measure of | ||||

| Indicates growth and measures the efficiency of sales and marketing departments | measures efficiency of different departments of entity in terms of cost management | |||

| Quantum of | ||||

| Total of all sales, generally higher than profit, can’t be negative | Determined by deducting expenses from revenue, generally lower than turnover, can be both positive and negative | |||

| Aspect | ||||

| Only revenue aspect of the entity is considered | Both revenue and expense aspects of the entity are considered | |||

| Indicator of financial health | ||||

| An indirect mean of performance evaluation, the turnover figure alone does not reveal the accurate information regarding entity’s financial health | A direct indicator of financial performance, the profit figure reveals the entity’s efficiency in terms of cost management within a certain quantum of revenue, widely used by stakeholders | |||

| Reporting in financial statements | ||||

| Reported on credit side of trading account | Presented as balancing figure on the debit side of profit and loss account | |||

| Formula to calculate | ||||

| Total turnover is equal to quantity sold during the period multiplied by sales price per unit. Total turnover = Quantity sold × Sales price per unit |

Determined by deducting expenses from total revenues collected during the period. Profit = Total revenues – Total expenses |

|||

Conclusion – turnover vs profit

While both turnover and profit differ on several parameters, they have one main similarity that they are both important parameters in assessing financial performance of an entity. They are used for comparative analysis of financial performance across different entities as well across accounting periods for the same entity. Neither turnover nor profit should be viewed in isolation – they should be correlated with each other to determine true picture of financial performance of the entity. High turnover has little meaning if it results in negligible profit. In the same way, higher profit percentage with very limited turnover is not ideal.