On the basis of core business activities, commercial entities can be broadly categorized as manufacturing and non-manufacturing entities. Non-manufacturing entities are further bifurcated into trading (i.e., merchandising) entities and service providing entities. The parameter that differentiates these entities is that the nature of core profit generating activities of each of the entity types is different. This difference necessitates modifications in the form of financial reporting that the entities adopt.

All entities draft an income statement to record their incomes and expenses and the resultant profit for each individual accounting period. Based on the type of entity and the way it conducts its business, the income statement is modified and prepared for appropriate reporting.

This article looks at meaning of and differences between two bifurcations of income statement based on the type of activities they record – trading account and profit and loss account.

Definitions and meanings

Trading account:

Trading account is the first part of income statement which records revenues earned from and expenses incurred on the trading or manufacturing activities for a specific period. The net result of this account is a gross profit or gross loss.

A trading account reflects gross profitability that is generated from the core business activities of manufacturing and merchandising entities. Service entities don’t engage in any trading or manufacturing activities and, thus, they don’t prepare a trading account.

Entries in a trading account are made as follows:

Entries on debit side

- Opening inventories of raw materials, work in progress and finished goods in case of manufacturing business and opening inventory of only traded goods in case of merchandising business.

- Direct expenses like raw materials, direct labor and manufacturing overhead, all as cost of goods sold. In merchandising businesses, the cost of merchandise purchased is entered in place of materials, labor and overhead.

Entries on credit side:

- Direct revenues like revenue from sale of manufactured goods (including by-products, if any) in case of manufacturing businesses and revenue from sale of traded goods in case of merchandising businesses.

- Closing inventories of raw materials, work in progress and finished goods in case of manufacturing business and closing inventory of only traded goods in case of merchandising business.

After recording all the entries, the trading account is balanced to result in gross profit or gross loss. This gross figure works as the starting point for drafting the profit and loss account to gauge entity’s net result.

Example:

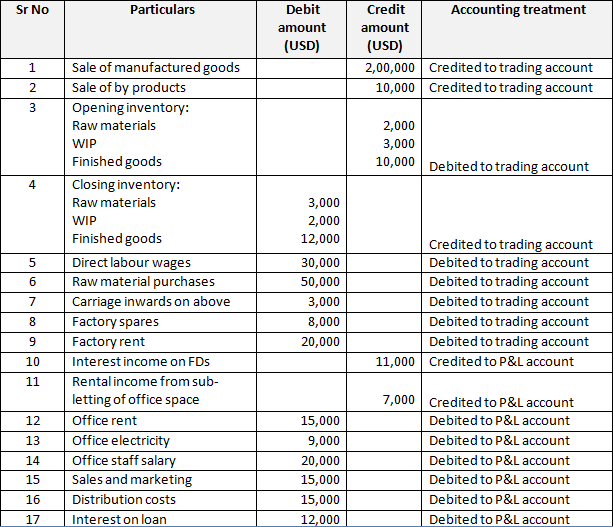

Eagle Inc., a manufacturing company, has the following incomes and expenses for the year 2020:

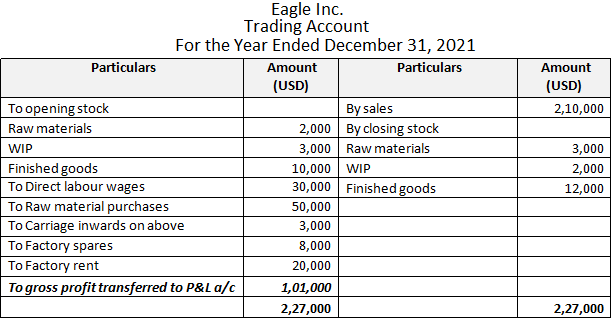

Eagle’s trading account can be prepared as follows:

Profit and loss account:

Profit and loss account is the subsequent part of the income statement which records indirect revenues earned from and indirect expenses incurred on entity’s business activities for a specific period. It essentially records all other incomes and expenses which are related to the business but are not directly related to the manufacturing and trading activities and, thus, do not find place in the trading account. The net result of the profit and loss account (net profit or net loss) represents the overall profitability of the business for the specific period.

Profit and loss account records indirect revenues and indirect expenses as follows:

- Indirect revenues like interest, dividend and rental incomes etc. are entered on the credit side

- Indirect expenses like administrative expenses, finance expenses, legal expenses, distribution expenses, advertising and marketing expenses etc. are entered on the debit side.

Once all the entries have been made, the profit and loss account is balanced and the net result in the form of net profit or net loss is arrived at. This net result figure is transferred to the profit and loss appropriation account or retained earnings account, the balance of which is reported in the balance sheet.

Example

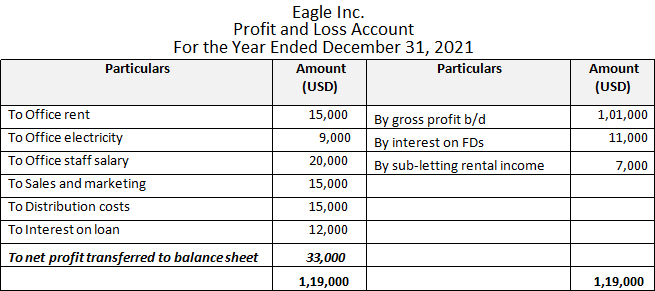

Continuing the same example as above, the profit and loss account of Eagle Inc. can be prepared as follows:

Difference between trading account and profit and loss account

The seven key points of difference between trading and profit and loss account have been listed below:

1. Meaning

- The trading account is the part of the income statement that records all direct incomes and direct expenses from trading or manufacturing activities.

- The profit and loss account is the part of the income statement that records all indirect incomes and indirect expenses from other activities of the business.

2. What it records

- Trading account records income such as sales of goods and by-products and expenses such as materials/goods purchased, direct wages, factory overheads etc. which are generated from merchandising or manufacturing activities of a business.

- Profit and loss account records all other incomes and expenses which are incurred during the course of other business operations but which are not directly attributable to the trading or manufacturing activities.

3. Hierarchy

- The trading account is the first part of the income statement and is prepared first.

- The profit and loss account is the second part of the income statement and is dependent on the preparation of the trading account.

4. Result

- The trading account results in determination of gross profit or loss.

- The profit and loss account results in determination of net profit or loss.

5. What it reflects

- The trading account reflects that part of profit or loss that can be attributable to the core business activities.

- The profit and loss account reflects the overall profitability after considering all business activities.

6. Balance transferred to

- The balance of trading account (i.e., gross profit) is transferred to the profit and loss account.

- The balance of profit and loss account (i.e., net profit) is transferred to the balance sheet.

7. Prepared by

- Trading account is only prepared by merchandising and manufacturing entities. Service businesses don’t produce or trade goods and, therefore, don’t draft a trading account.

- Profit and loss account is prepared by all business entities and formats, including service entities.

Conclusion:

The key difference between a trading account and a profit and loss account is that the former records the entries related to direct or core business activities and reveals the gross result of the business while the latter focuses on the other operating activities that are not core in nature and reveals the net result of the business as a whole.

The purpose of the two accounts is to reflect business profitability at gross and net level. A bifurcation between the two is important as it helps management ascertain and analyze how activities of core and ancillary nature impact ultimate profitability of the business. For example, it may happen that the trading account shows a gross profit but the profit and loss account results in a net loss. This could mean that the gross margins are not enough to sustain the overall business expenses. It could also mean that the non core business activities of the entity are being carried out inefficiently and are converting a profit into a loss. The detailed bifurcation of trading and profit and loss can thus helps management analyze the nature of profitability and take action to improve the same.