The accounting cycle of an organisation encompasses all the steps that result in the presentation of financial statements of an organisation. This begins from charting of all accounts to journalizing to posting to drawing up of profit and loss account and balance sheet.

This article looks at meaning of and differences between two steps of this accounting cycle – trial balance and balance sheet.

Definitions and meanings

Trial balance:

Trial balance is a complete listing of all ledger account balances at the end of a specified period. These account balances include all real, personal and nominal account balances impacted by journal entries.

Trial balance is prepared once all journal entries are posted to the respective ledger accounts and each ledger account is totaled and balanced. It is presented in columnar format, with debit account balances recorded on the left and credit account balances recorded on the right.

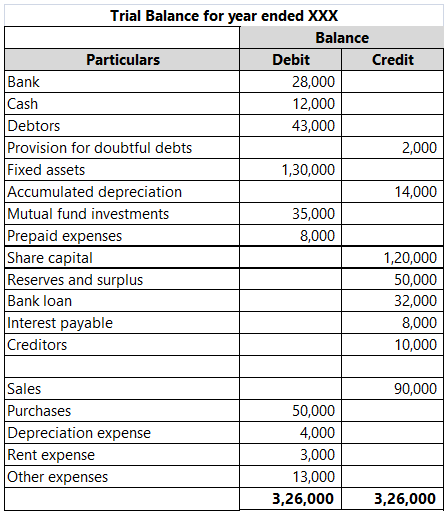

An example of a trial balance is as follows:

The primary purpose of compiling a trial balance is to check the arithmetical accuracy of the accounts. In a double entry accounting system, each journal entry has an equal debit and credit impact. Thus a tallied trial balance i.e., where debit balances equal credit balances, serves as a check on this.

Balance sheet

A balance sheet is a financial statement which represents the position of assets and liabilities of an organisation as on a specific date. This date is generally the last date of the accounting period.

Assets are financial resources owned by an organisation which can be converted into monetary value. These include fixed assets and dues receivable. Liabilities represent a future monetary obligation. This includes all amounts that are payable and outstanding on the specified date. The net difference between the assets and liabilities represents the owner’s equity in the business.

The balance sheet thus is a snapshot of what the company owns and what the company owes including the value of owner’s equity. The balance sheet is important for various stakeholders to understand the financial position of an organisation at any specific point. Various key ratio analysis can also be done from the information presented in the balance sheet.

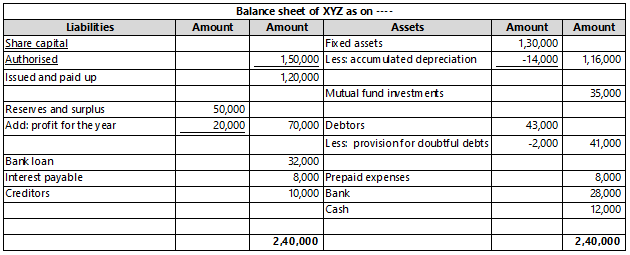

A format of the balance sheet derived from the trial balance in the above example is as follows:

Nominal account balances from trial balance are posted to the profit and loss account to arrive at net profit. Subsequently, this net profit as well as the balances of real and personal accounts from the trial balance is recorded in the balance sheet. Balance sheet is prepared in ‘T’ format with liabilities recorded on the left and assets recorded on the right.

This completes the accounting cycle.

The financial snapshot reflected by the balance sheet is vital for several stakeholders as follows:

- Management – to understand financial implications of the business operations and to determine future course of action for the business.

- Investors and potential investors – to gauge the security and growth potential of their investment in the company.

- Suppliers – to gauge credibility and business prospects of the organisation.

- Lenders – to gauge credit worthiness of the company and its ability to pay back loans taken.

- Regulators – to keep a check on financial condition of the company especially if it involves public money such as in the case of listed companies or companies accepting deposits from the public.

Differences between trial balance and balance sheet:

The difference between trial balance and balance sheet has been detailed below:

1. Meaning

- Trial balance is a compiled list containing all ledger account balances.

- Balance sheet is a financial statement which reports the financial condition i.e., net position of assets and liabilities of an entity on the last day of an accounting period.

2. Prepared from

- Trial balance is prepared once all ledger accounts are totaled and balanced.

- Balance sheet is prepared once trial balance is compiled and subsequent to drawing up of profit and loss account.

3. Content

- Trial balance includes all real, personal and nominal account balances.

- Balance sheet includes only real and personal account balances. Nominal account balances are accounted for through profit and loss a/c.

4. Format

- Trial balance is prepared in columnar format with debit balances in the left column and credit balances in the right column.

- Balance sheet is prepared in ‘T’ format with liabilities on the left side and assets on the right side.

5. Purpose for preparation

- The main purpose of preparation of trial balance is to check arithmetical accuracy of books of accounts.

- The main purpose of preparation of balance sheet is to summarize and present the financial situation of the company.

6. Included in financial statements

- Trial balance is only a list of accounts and is not considered as a financial statement for reporting purposes.

- Balance sheet is a key financial statement.

7. Sign off

- Trial balance, not being part of financial statements is an internal purpose document and does not require auditor sign off.

- Balance sheet is prepared for external reporting use and requires auditor sign off in cases where audit is applicable.

Trial balance versus balance sheet – tabular comparison

A tabular comparison of trial balance and balance sheet is given below:

|

||||

| Meaning | ||||

| List of all ledger account balances | Financial statement showing position of assets, liabilities and owner’s equity | |||

| Prepared from | ||||

| Ledger accounts | Trial balance and profit and loss a/c | |||

| Content | ||||

| All real, personal and nominal account balances | Real and personal account balances | |||

| Format | ||||

| Columnar format recording debit balances in the left column and credit balances in the right column | ‘T’ format with liabilities on the left and assets on the right | |||

| Purpose of preparation | ||||

| To verify arithmetical accuracy of books of accounts | To present financial status of the business | |||

| Included in financial statements | ||||

| No | Yes | |||

| Signoff | ||||

| Auditor signoff not required | Auditor signoff required if audit is applicable | |||

Conclusion – trial balance vs balance sheet

Trial balance is primarily used for internal use of accountants and auditors to check arithmetical accuracy of books. Balance sheet on the other hand plays a more pivotal role in the accounting cycle as it is reported externally and relied upon by several stakeholders. Accountants and auditors thus focus on ensuring that the balance sheet presentation is accurate.