Companies use different types of books to record different types of business transactions in which they engage during the course of various business activities. These books are commonly named as books of prime or original entry and can be broadly divided into two types – special journals and general journal.

Special journals are also called day books and usually include sales journal or sales day book, sales return journal or sales return day book, purchases journal or purchases day book, purchases return journal or purchases return day book, cash receipts journal or cash receipts day book and cash payments journal or cash payments day book. These journals are mostly used to accumulate data relating to transactions that are repetitive in nature.

General journal is used to record such transactions that are not repetitive in nature and for which no special journal is maintained.

Definitions and meanings

Special journal

Special journal is a book of prime entry that is used to analyze and record specific business transactions like credit sales and credit purchases. Purpose of the special journal is to differentiate specific transactions from other transactions so that they can be better managed, handled and controlled. Special journal has six common types knows as:

- Sales journal

- Sales return journal

- Purchases journal

- Purchases return journal

- Cash receipts journal

- Cash payments or disbursements journal

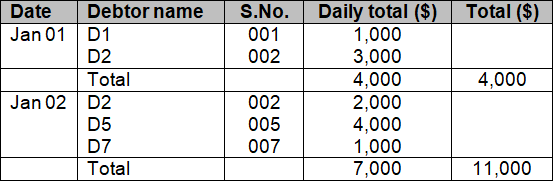

Sales journal is also called sales day book and is used to record credit sales of the business. When recording credit sales name of debtor to whom sales are made are also shown along with its account number on the sales journal. Sales journal looks like

Sales return journal which is also called sales return day book is used to record the credit sales returned from debtors. Its format is same as sales journal.

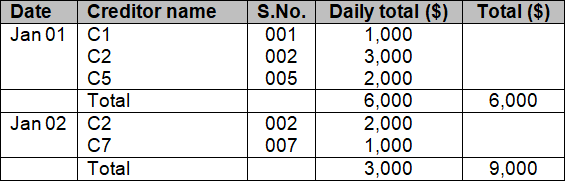

Purchases journal is also called purchase day book and is used to record the credit purchases of the business along with creditor name and its account number from which purchases have been made. Purchases journal looks like

Purchases return journal which is also called purchases return day book is sued to record credit purchases returned to suppliers. Its format is same as purchases journal.

General journal

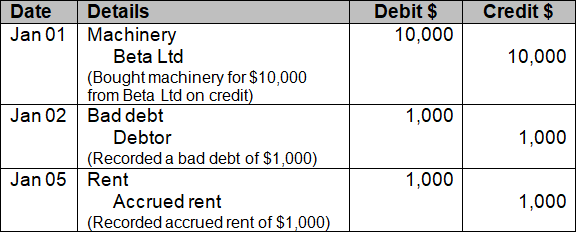

General journal is also a book of prime entry that is used to record all other transactions which are not recorded in the special journals and cash book. It normally includes entries for adjustments like accruals and prepayments, correction of errors, bad and doubtful debts, depreciation, writing down of inventory and sale and purchase of non-current assets. All the transactions in general journal are recorded in form of double entry. General journal also acts as authorization because all the entries in the journal will be prepared or reviewed by the financial accountant.

It looks like as below:

In addition to four columns used in above format of general journal, sometime a posting reference column is also used to record the page number particular account in ledger. This column is helpful to locate a particular account from the ledger book. In a computerized accounting system, this column is used to enter account number in the company’s general ledger.

Difference between special journal and general journal

The main difference between general journal and special journal is given below:

1. Purpose and nature of transactions recorded

In special journals, all the recorded transactions are of similar nature. For example all the credit sales are recorded in special journal and all the credit purchases are recorded in purchases journal. General journal is used to record all other transactions which no special journal is maintained. Such transactions may include adjustments for accruals and prepayments, bad debts, correction of errors, closing entries and sale and purchase of non-current assets.

2. Suitability and use:

General journal is suitable for small businesses where only a few transactions occur on daily basis. The small businesses may not need to maintain a special journal for different nature of transactions because only general journal may be sufficient to work as the book of original entry. Special journals are maintained by medium and large businesses where numerous transactions of similar nature occur in a single day and it becomes difficult to record all those transaction by a single bookkeeper in one journal.

3. Method of recording the transactions

In general journal all the transactions are recorded in the form of two or more line entry (i.e., debit part in first line and credit part in second line) whereas in special journals all the transactions of sales and purchases are recorded as single line entry with reference of debtors and creditors etc.

4. Posting to the ledgers

All the transactions in general journal are posted in general ledger whereas in special journals all the transactions are posted in general as well as in personal ledgers.

5. Accumulation of transactions

In special journal all the transactions are accumulated and then the total is periodically posted to the ledgers whereas in general journal the transactions are not accumulated and are posted individually to the ledgers.

6. Number of columns used

The basic format of a general journal is usually simple which includes a date column, a description column, a posting reference column, a debit entry column and a credit entry column. A special journal, on the other hand, is a more systematic form of recording transactions and may consist of many columns depending on the information needs of the bookkeepers, accountants, managers, owners and auditors etc.

General journal vs special journal – tabular comparison

A tabular comparison of general journal and special journal is given below:

|

||||

| Nature of transactions recorded | ||||

| Transactions of similar nature are recorded | Transactions of different natures are recorded | |||

| Suitability and use | ||||

| Used by medium and large businesses with a huge volume of transactions on daily basis | Used by small businesses usually with a small number of daily translations. | |||

| Method of recording transactions | ||||

| All the transactions are recorded in the form of single line item | All the transactions are recorded in the form two or more line items (i.e., debit and credit aspects of each transactions) | |||

| Posting to ledgers | ||||

| All the transactions from special journals are posted to general as well as personal ledgers | All the transactions in general journal are posted to the general ledger | |||

| Accumulation of transactions | ||||

| All transactions are accumulated and then total is posted to the ledgers | Transactions are not accumulated and individual transactions are posted to the ledger | |||

| No. of columns used | ||||

| More detailed information for each transaction is entered. Many columns are used depending on the type of journal and information recording needs of the company. | Date, description, debit entry and credit entry columns are the basic requirement in case of general journal. | |||

Conclusion – general journal vs special journal

Special journals and general journal are both books of prime entry which are used to record the transactions of a business. In special journals all the transactions related to credit sales, credit sales return, credit purchases and credit purchases return are recorded. In general journal all other transactions are recorded which include adjustments to accounts like sale and purchase of non-current assets, accruals and prepayments, bad debts and correction of errors etc. In special journals all the transactions are recorded in the form of single line entry whereas in general journal all the transactions are recorded in the form of two or more line entries.